Sprout Social IPO’d in Dec 2019 at an $800m market cap

It IPO’d early, in a crowded space. But they kept on going, and gong, and growing.

2.5 years later, in a market down 50% …

They’re worth $2.7 Billion#golong pic.twitter.com/nA8jSXgehx

— Jason ✨BeKind✨ Lemkin #ДобісаПутіна (@jasonlk) May 20, 2022

The markets for SaaS and Cloud stocks are down 50%+ in just a few months, and it hasn’t spared even the leaders.

But let’s step back a bit … the damage hasn’t been even, and capital-efficient SaaS stocks in many cases have held up pretty well if you put aside the markets at Peak Covid.

A few case studies:

* Sprout Social IPO’d in December 2019 at an $800m market-cap. It’s tripled. Its PLG-assisted sales motion has kept it capital efficient, and today it’s worth $2.7 Billion.

* ZoomInfo was the first post-Covid IPO in June 2020, and it priced at $8.3 Billion. It’s doubled. It went on to accelerate its profitable growth and today sits at a $16 Billion market cap.

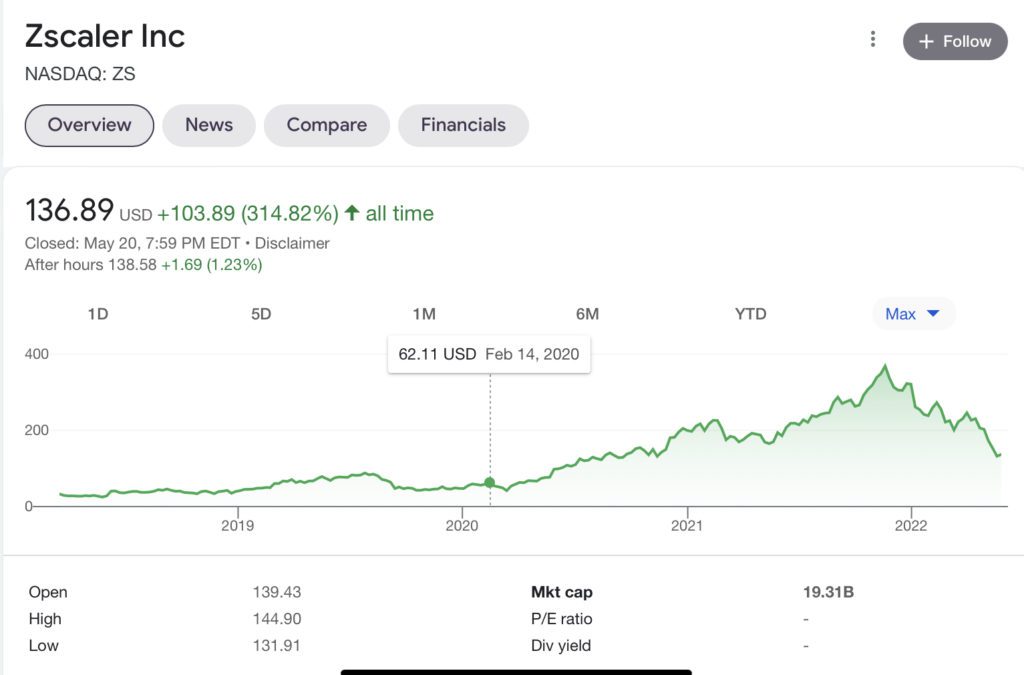

* Zscaler’s market cap before Covid was about $6B. It’s tripled. Today, it’s $19B. Efficient and epic growth. More here.

Now all these stocks were even higher at the 2021 market peaks. Everything was, and if you pick that measurement point, all comps are tough. But instead, take a look at these 3 SaaS leaders from the perspective of an incredible 2 year run. They look awfully impressive, even in today’s times.

Why? Efficient growth is even more in fashion today.

I’m not saying it’s easy out there right now. The markets are brutal.

But some, the efficient, are still shining fairly bright. And likely have a great run ahead of them.

……..

We dug in here and more the other day on This Week In Startups: