So when I was a founder, I didn’t pay much attention to how VC funds themselves worked. I just pitched them.

But fast forward to today, and there is an incredible amount of information about how the industry actually works, and we put a bunch of the best stuff on SaaStr itself.

Most important today is for founders to know (1) how active the venture markets are, at each stage and (2) how healthy venture is overall. This you should know as a startup CEO or founder or executive. And importantly, I find most founders are still too optimistic here. They still think it’s all easier right now than it really is. So you have to see the data, and speak with it.

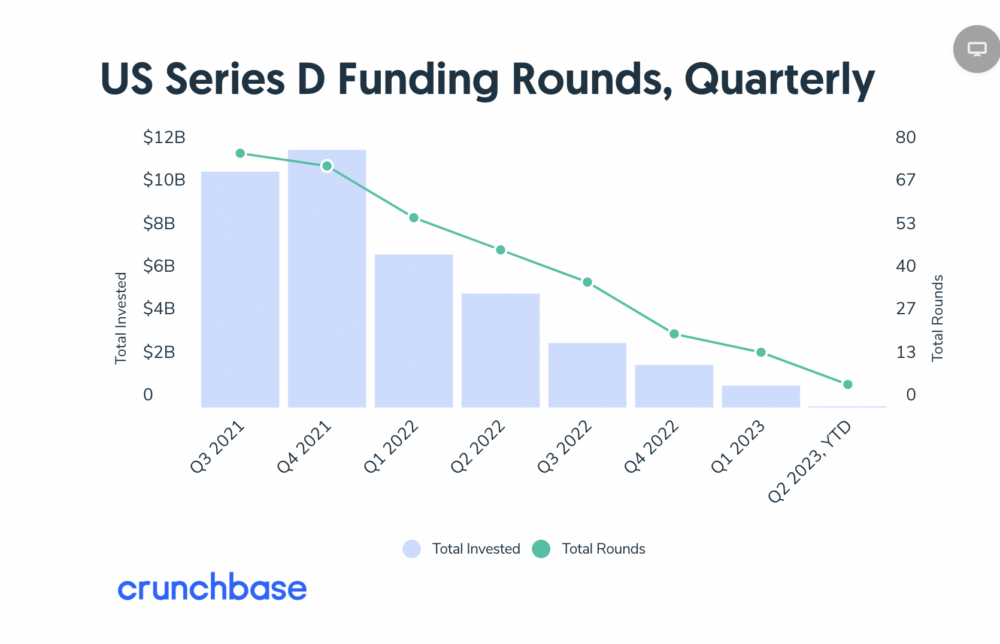

In terms of each stage, everything is now down. Most dramatic is later-stage investing, with the latest Crunchbase data showing Series D rounds are now own 92% (!) from the peak and 86% from a year ago:

Take out the $300m+ round for Wiz, and in fact, it’s almost 100% frozen. Other stages are down as well, but seeing the above shows you just how down the latest stages are.

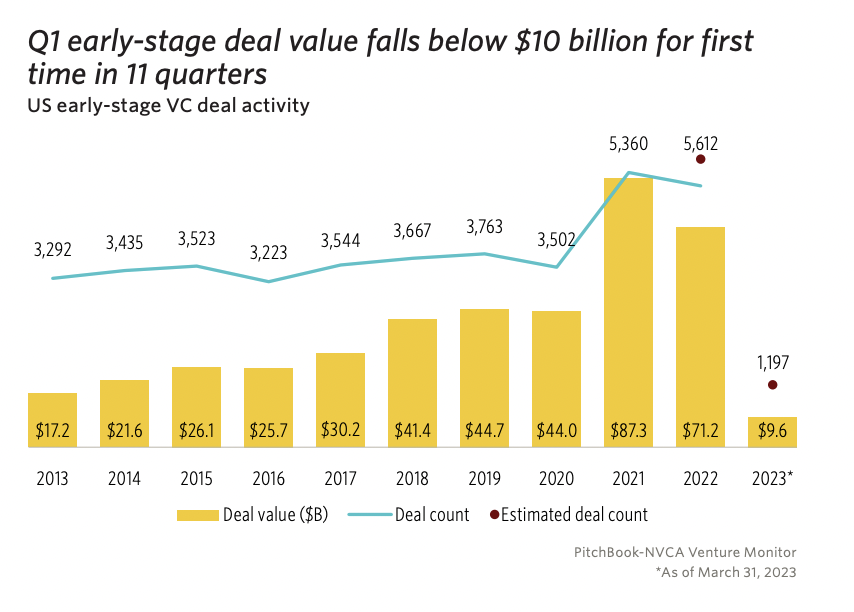

Earlier-stage is way down too, falling below $10 Billion total in Q1 for the first time in a decade:

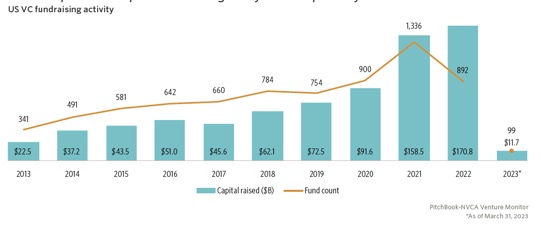

But what about VC funds themselves? How flush are they with cash, not just today — but for the future?

And here’s a very telling metric: VCs have to fundraise themselves to get the money to give to founders. They raise money from LPs, or Limited Partners. And that fundraising is down to a 10+ year low!

Now what does that mean? Well, it doesn’t mean VCs have no money to invest … today. They are indeed still sitting on funds they raised last year and the year before at record levels, per the chart above.

But it does mean almost every VC fund is going to be even more cautious. The issue isn’t just exit multiples or growth rates. It’s also now that they are having a much tougher time raising funds themselves to give to startups.

If that doesn’t last more than a quarter or two, startups won’t really notice. But if this trend continues (and there’s no reason right now to believe otherwise) … it likely will make million+ checks even harder to get in the coming quarters. When VCs aren’t sure they’re going to have nearly as much money to invest themselves going forward.

In tougher times, it’s almost always better to just raise now if you can. This is one more reason.