So there are 3 things every sales rep I’ve worked with hates:

- Clawbacks. When they have to give back some of their commission if a customer cancels early.

- Tracking-to-Cash, i.e. paying commissions once cash is received, not just once the deal is signed; and

- A Low Base Salary, No Matter How Much They Make. We won’t dig into this too much here, but sales folks hate it. Even if their effective comp is 3x, 5x, even 10x their base. They just hate having a low base salary.

Let’s dig in a bit here, and I’ll at least share my learnings. I think all 3 are useful tools, but you need to be thoughtful about using them and not accidentally abusing them and creating more friction with your team than they are worth.

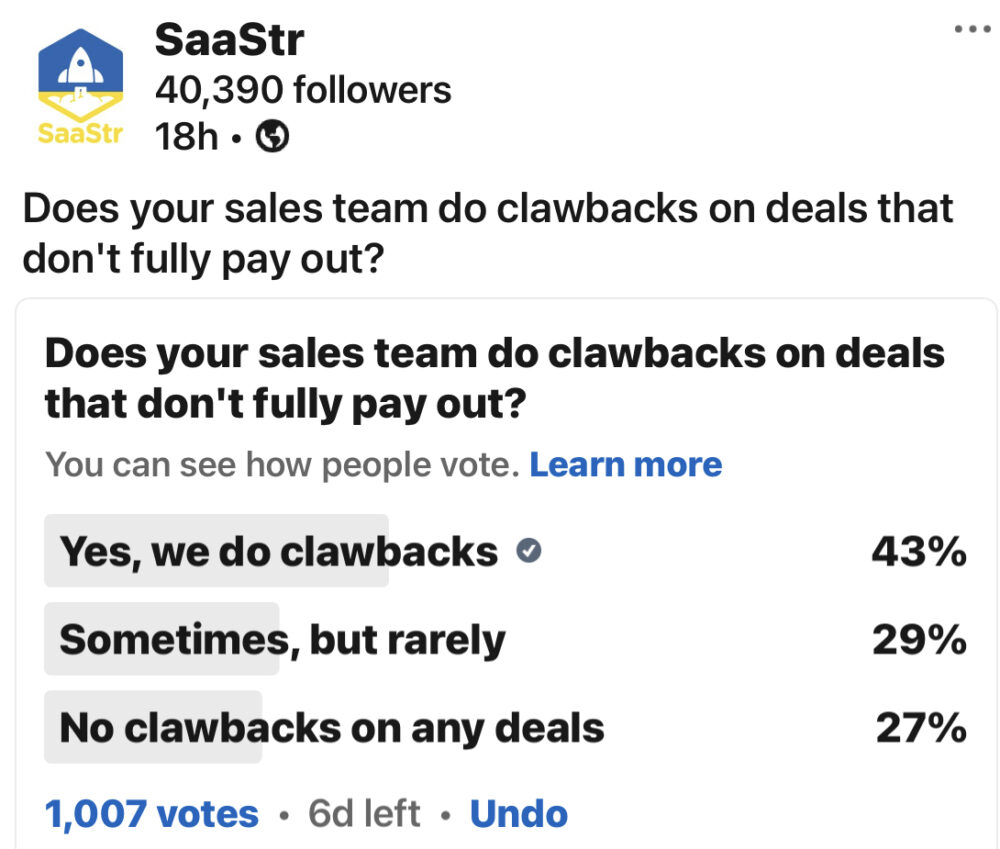

Let’s start with Clawbacks. Everyone in sales hates them. They don’t want any risk they have to give back part of a commission. But two thoughts:

- First, clawbacks rarely are that big of a deal in the end in terms of comp impact. Most customers pay, and most pay on time. It’s rare to see clawbacks impact even 5% of a rep’s comp. That’s both an argument not to do them, and to reps, not to overly worry about them.

- But … here’s the thing … I find clawbacks one of the most powerful tools to mitigate churn-and-burn deals. Clawbacks don’t stop low quality, churn-and-burn deals. But they are a clear sign to the sales org that there is at least a cost to closing low-quality deals. I find this is very helpful in curbing sales rep behavior that crosses the line into too aggressive. It doesn’t stop it, but it helps curb it. Each clawback is inherently a slap in the face, a sign a deal at least might have been done wrong. It creates a discussion, it flags a potential issue, and it acts as a deterrent. Even if the real world impact in slight.

So much as almost every sales rep I’ve worked with challenged me here, I do love the clawback. When in doubt, I don’t actually claw it back. But if it was a bad deal, a churn-and-burn, I do. It sends the right message to the org.

Ok, how about Tracking to Cash? I.e., only paying sales commissions once you actually receive the cash? 100% of sales reps also hate this. They want to get paid when the deal is e-signed, and they don’t want to be pushed into the collections business. But it just makes so much sense to founders. Because it aligns sales with the company itself so much better. Here’s where I come out:

- If cash is very tight, pay commissions when cash is received, period. Folks may gripe, but they’ll get it. Usually, at least.

- Once cash flow is better established, pay more deals when the contract is e-signed. If 95%-100% of customers pay, and pay promptly, and you have enough cash now in the bank, then making the sales reps wait to get paid just creates frustration that’s just not necessary. You want your sales team closing a lot, and making a lot. You don’t want blockers.

- But … here’s the thing … this breaks if cash is deferred by the terms of the deal. So what I’ve come up with is paying commissions on the Net 30 portion of the deal upfront, and any part that isn’t Net 30, once cash is received. Folks that sell usage-based products often do something similar in the middle, paying out 50% of expected usage upfront, and 50% over the first year. In any event, I’ve found paying a 100% commission on cash that isn’t Net 30 creates bad incentives. Incentives for bad terms, and bad deals, and deals that don’t generate enough upfront cash. So just like clawbacks help align on Churn-and-Burn deals, deferring commissions on at least some comp that isn’t Net 30 or better makes sure payment terms stay standard, and cash continues to come in the door.

Can you control some of this with a strong CPQ and/or a strong contract approval process? Yes, you can. But folks will still want to make as many exceptions as they can get away with in many cases, to just get the deal done. So I like getting some help from these 2 controls. Not too much, but a little extra help from clawbacks from bad deals, and from not paying out a full commission on any cash that is longer dated than Net 30.

OK, and finally, what about the combo of Lower Base but High OTE and Higher Commissions? A lot of founders like this, because again, it aligns with the company’s interest better. You can do it. But most reps would rather choose a lower commission and a higher base, even if that isn’t 100% rational. My suggestion? Split this one down the middle.

A related post here:

(clawback image from here)