Mina’s App of the Week

By Mina Guirguis, Marketing Consultant at Heinz Marketing

As a marketer, we often report to CROs, CEOs, and CFOs. What do all these people have in common? They think in terms of revenue. What’s the ROI of this campaign? Is this initiative going over budget? How will this help us increase our cash flow? These aren’t the easiest questions to answer as a marketer. To help marketers (and really anyone) understand the finance side of business, I recommend understanding your own finances first. That’s why my app of the week is Personal Capital.

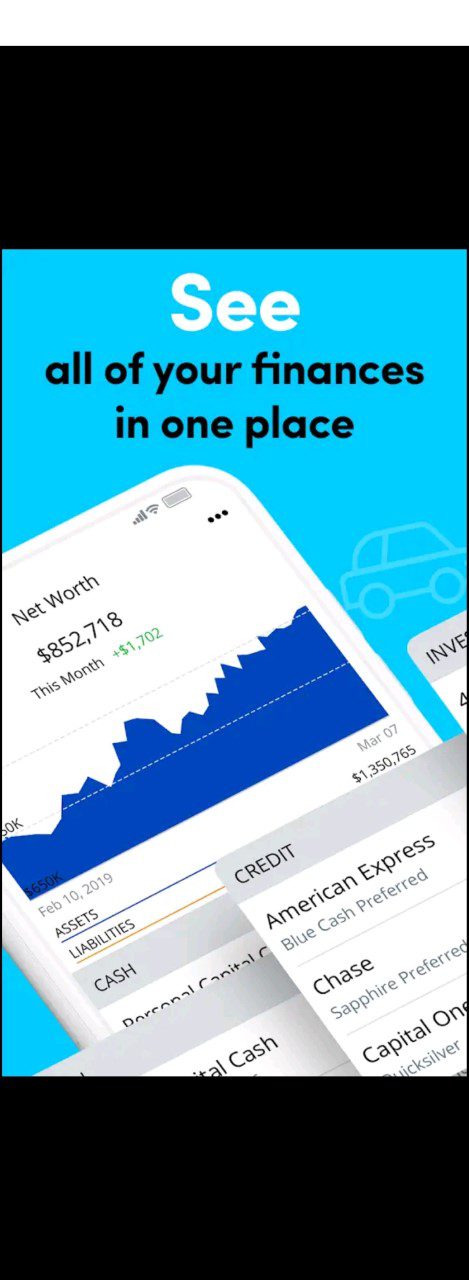

In my former life, I was a financial advisor, and what I learned is that no matter someone’s education level, salary, or job title, everyone can benefit from a more robust personal finance plan. My favorite feature of Personal Capital is it allows you to link all your accounts to the app so you can get a high-level view of your overall financial health and net worth. Worried about safety? According to the Personal Capital website, they “secure all data with AES-256 encryption, the same rigorous standards used by the US military.” Still not comfortable linking accounts? You can manually enter your transactions and use the app as a bookkeeping platform. That’s not even the best feature of the app.

Budget Setting

Personal Capital allows you to set budgets to help you track spending down to the individual transactions in different categories. Or if you want a bird’s eye view look, you can simply set a monthly budget and Personal Capital will help you stay under it. If you linked all your accounts, this is done completely automatically as Personal Capital updates every time you sign in. My favorite part about the budgeting feature is seeing my cash flow over time. Am I spending more than I’m bringing in? Should I start saving a bit more? All of that is easy to see with Personal Capitals awesome UI.

Customization

That UI is not only super user friendly, but it is also very visual. Do you hate looking at giant spreadsheets of numbers? Personal Capital turns all those transactions and numbers into clean graphs and charts that you can customize with a few clicks. You can easily bounce between your accounts and go into as much or as little detail as you are comfortable. Which is one of the biggest reasons I recommend Personal Capital to everyone. It truly fits your needs regardless of your financial literacy.

That customization goes into what you want to track as well. Want to see how close you are to hitting your retirement number? Done. Monitor how your stocks are comparing to the Dow Jones or NASDAQ? You got it. No matter what you choose to track, Personal Capital can help. I check it every day to remind me of my financial goals and what I have accomplished.