Dear SaaStr: Should I Buy My Stock Options After Leaving a Startup?

This is one of the trickiest questions of all. Especially these days, with so many struggling unicorns, and public SaaS stocks down 50% or more in many cases.

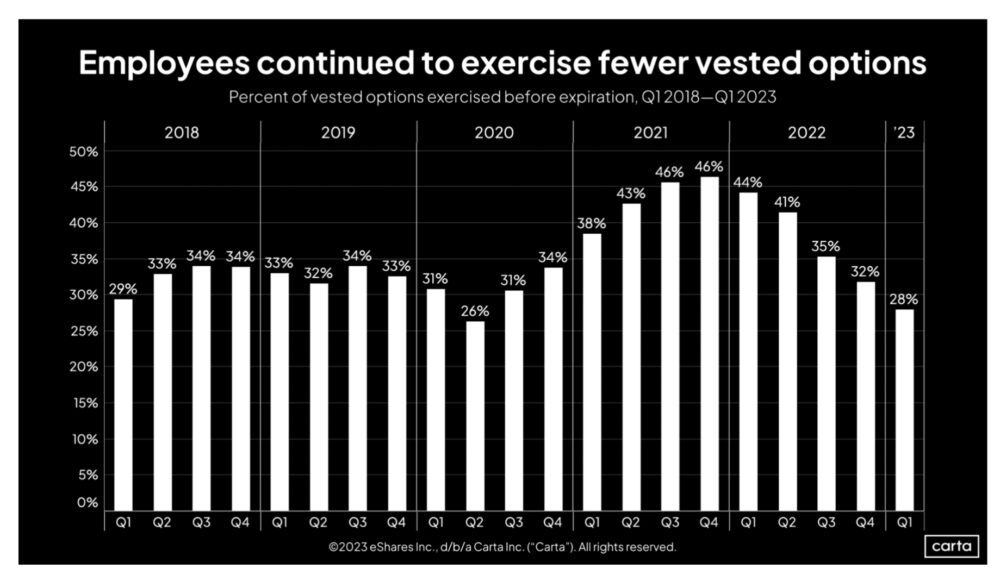

You can see from the above Carta data, that over time, from 20%-40% of employees actually exercise their options. More in good times, less in less good times, but never even a majority actually exercise their options.

As a start-up employee:

- You can’t possibly have enough experience or information to know if you should exercise or not;

- Even if the company is doing well — is the price too high? How do you know? and

- The total cost to exercise often can be pretty substantial in the aggregate.

But … you do have legal inside information on this trade. Maybe for one of the few times in your life. You roughly know if the company is doing well. And you almost certainly will know if it’s doing really, really well.

So my rough guidelines:

- If the company is doing well (i.e., revenue growing quickly, not burning too much); and

- Your 409A / exercise price is relatively low (you should be able to tell this on Carta); and

- The total cost to exercise is < 5-10% of your savings …

Then do it. Then buy the shares. This is one of the few times in your life you can legally buy with inside information.

But it’s > 5-10% of your savings, the price seems way too high, and/or the company is struggling … well, that’s why they call it an option. Maybe pass.