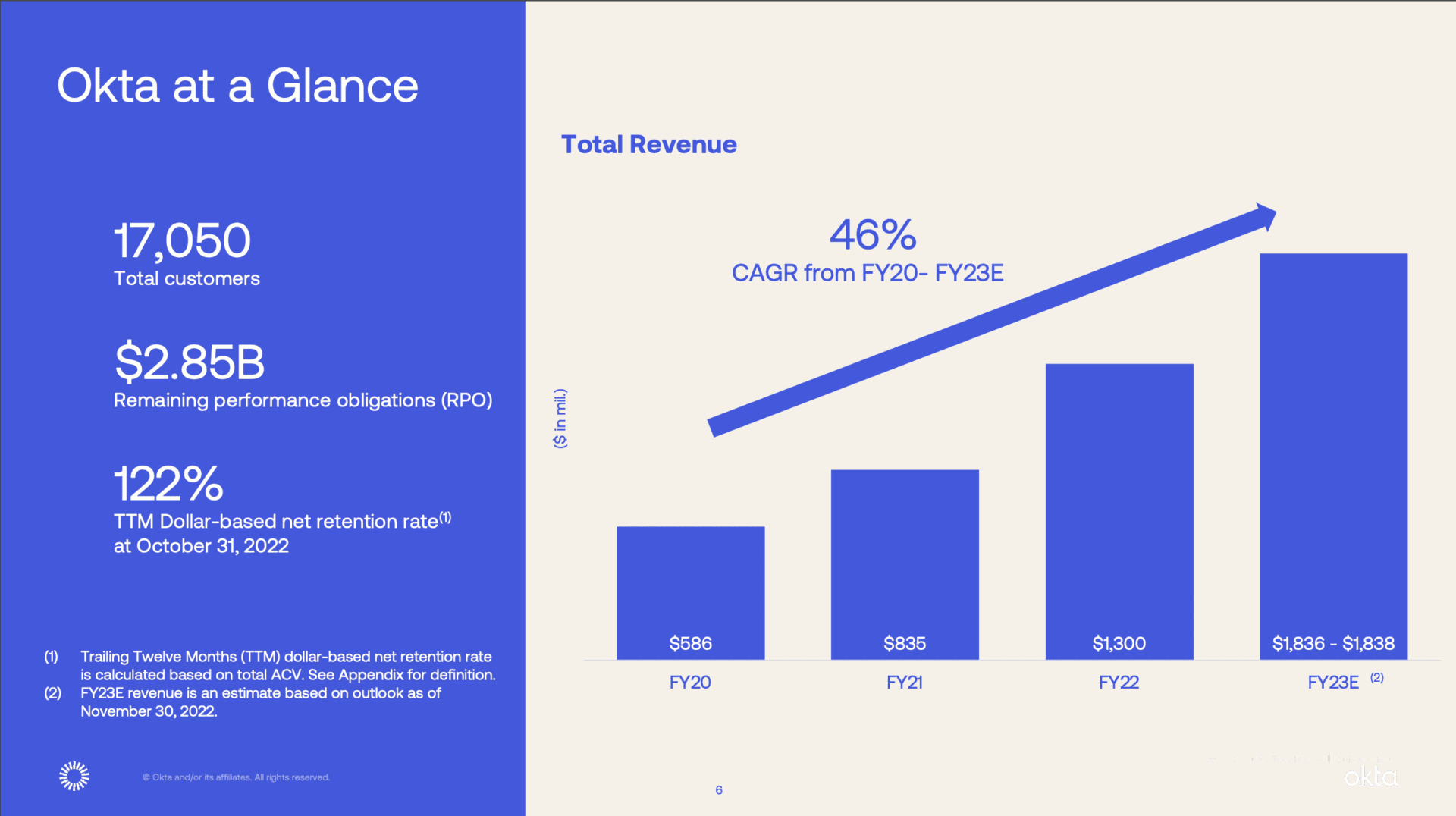

So Okta is one of the leaders in SaaS that has always just kept growing. They had a bit of dip in growth as they worked to integrate the mega-acquisition of Auth0 — but then went right back to growth. Even now, even in times of tighter scrutiny of budgets.

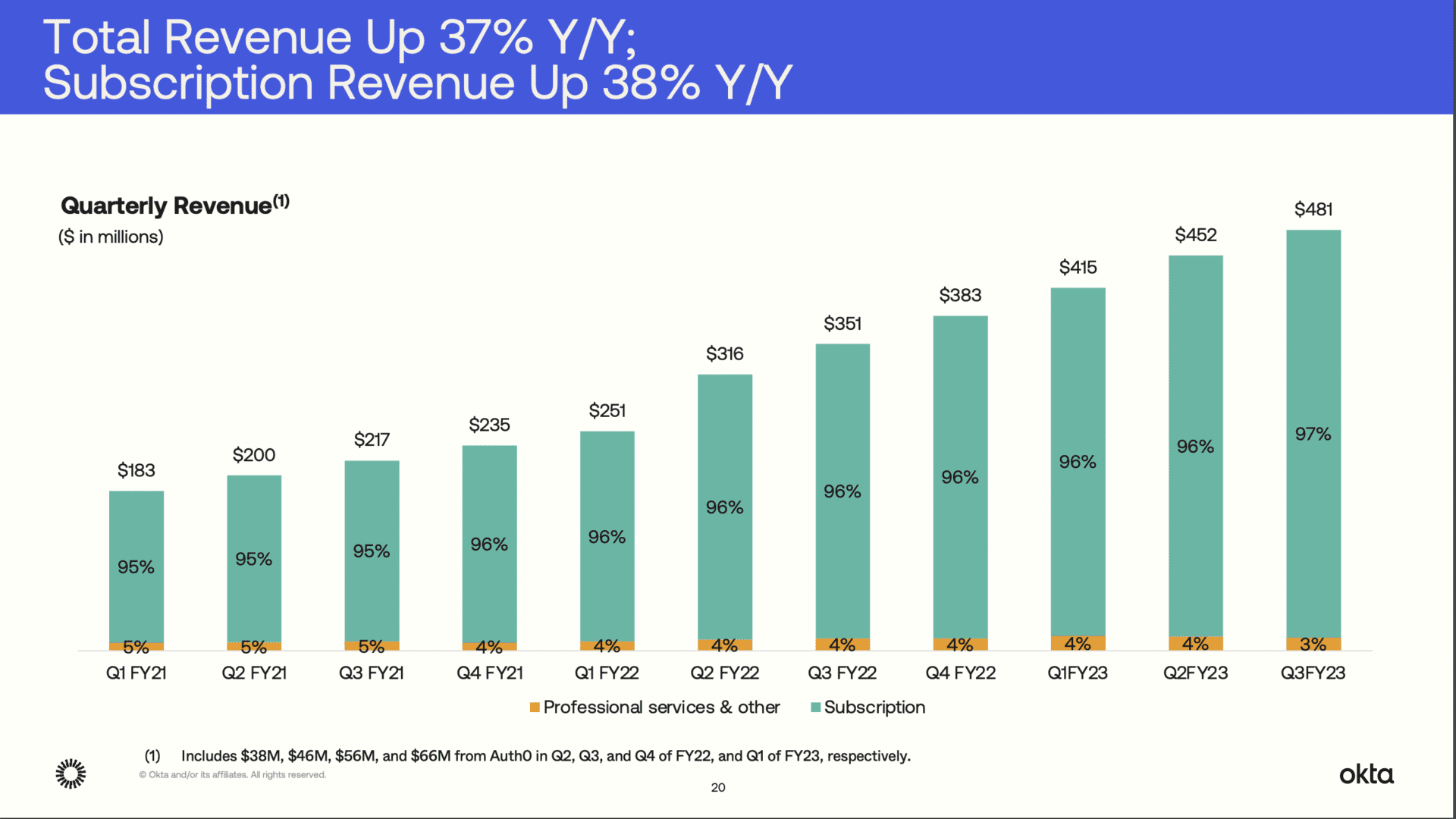

Okta is now crossing $2B in ARR, growing a stunning 37%.

5 Interesting Learnings:

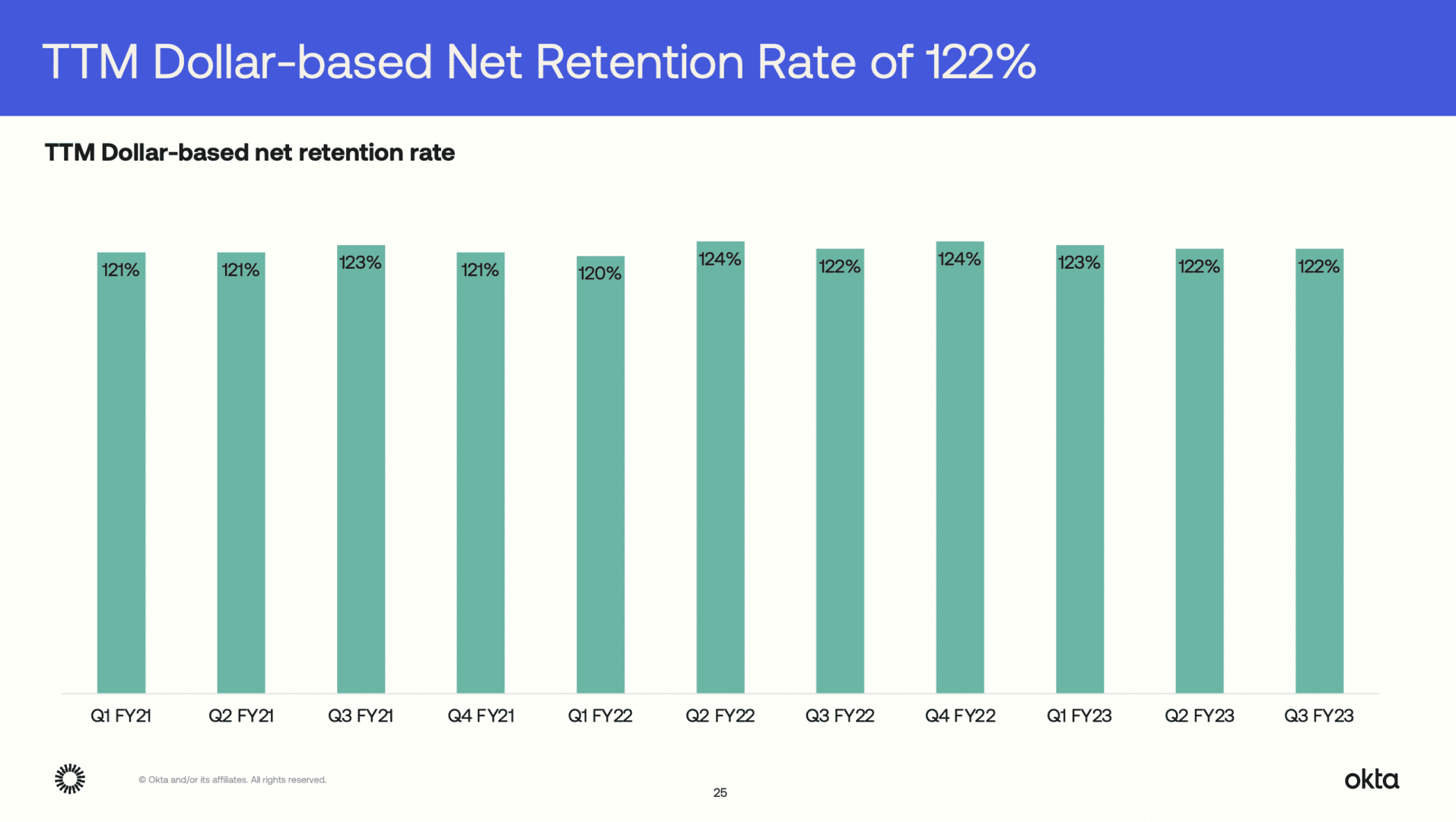

#1. 122% NRR — Basically The Same as 123% at $1B ARR. Okta has done an excellent job at keepings its NRR at 122%-123% all the way to $2B in ARR. And that’s up from 118% at IPO.

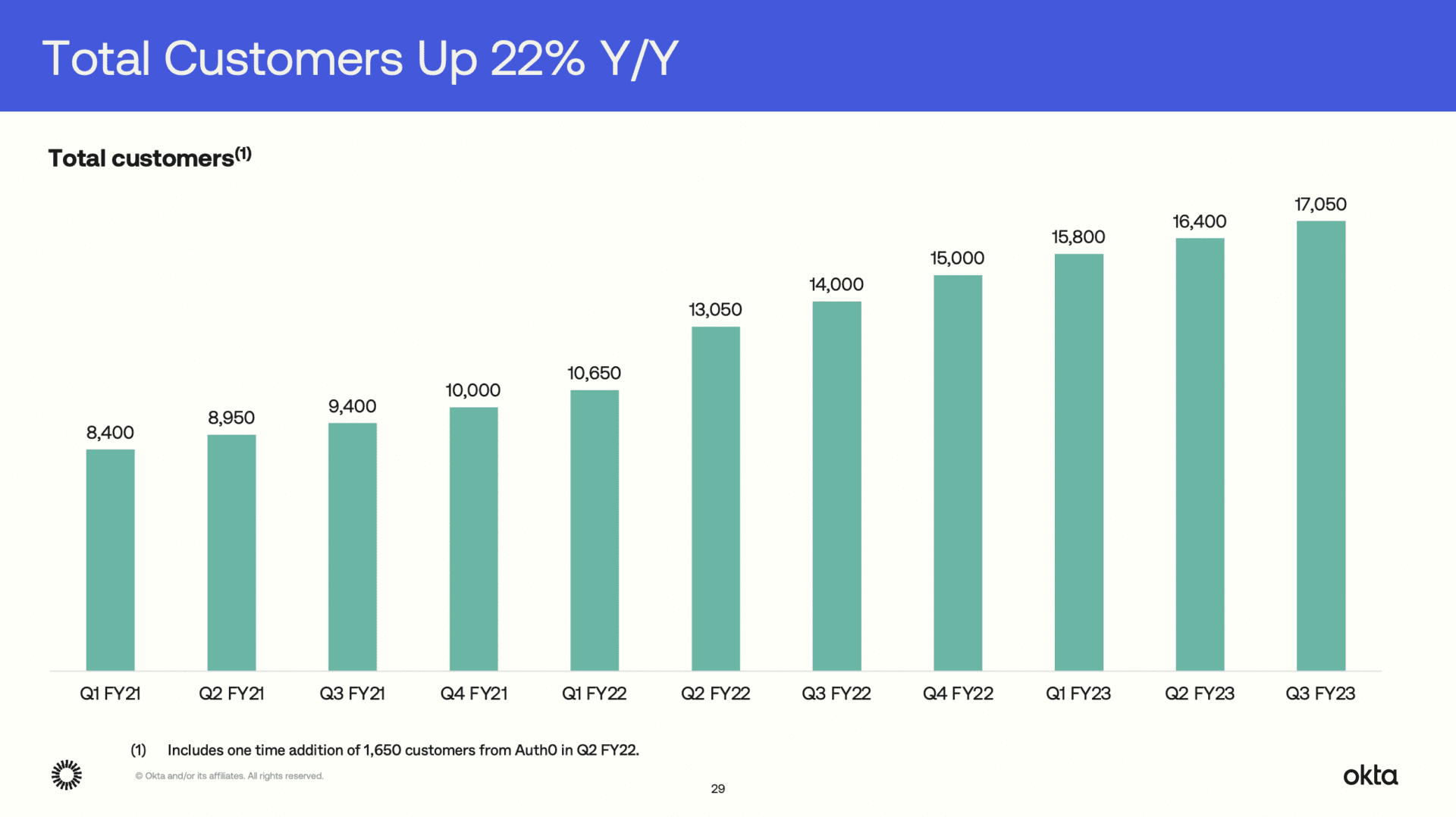

#2. 17,050 customers, so about $110,000 per customer on average. A nice sweet spot for a mix of inside and outside sales.

#3. Very Few Professional Services — Only 3% of Revenues. ProServ is only 3% of Okta’s revenues. They have partners do the heavy lifting here, as necessary.

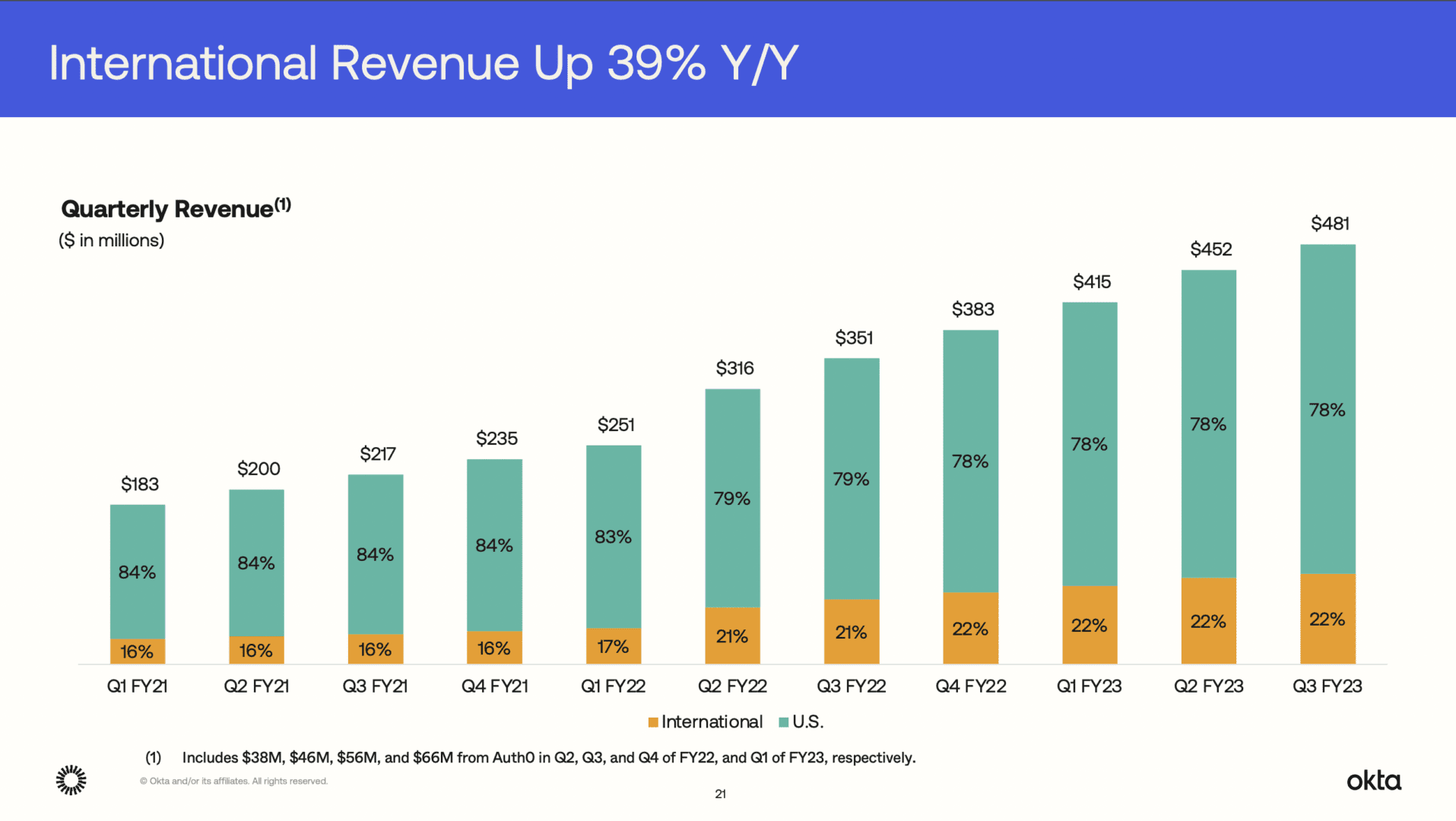

#4. International Revenue Steady at 22% of Revenues — and EMEA is strong. I actually would have expected this to go up since $1B in ARR, but products with a security and regulated element do have a harder time naturally crossing borders. But 22% is still a big boost. And interestingly, while some SaaS leaders are reporting the biggest softness in Europe and EMEA, Okta isn’t.

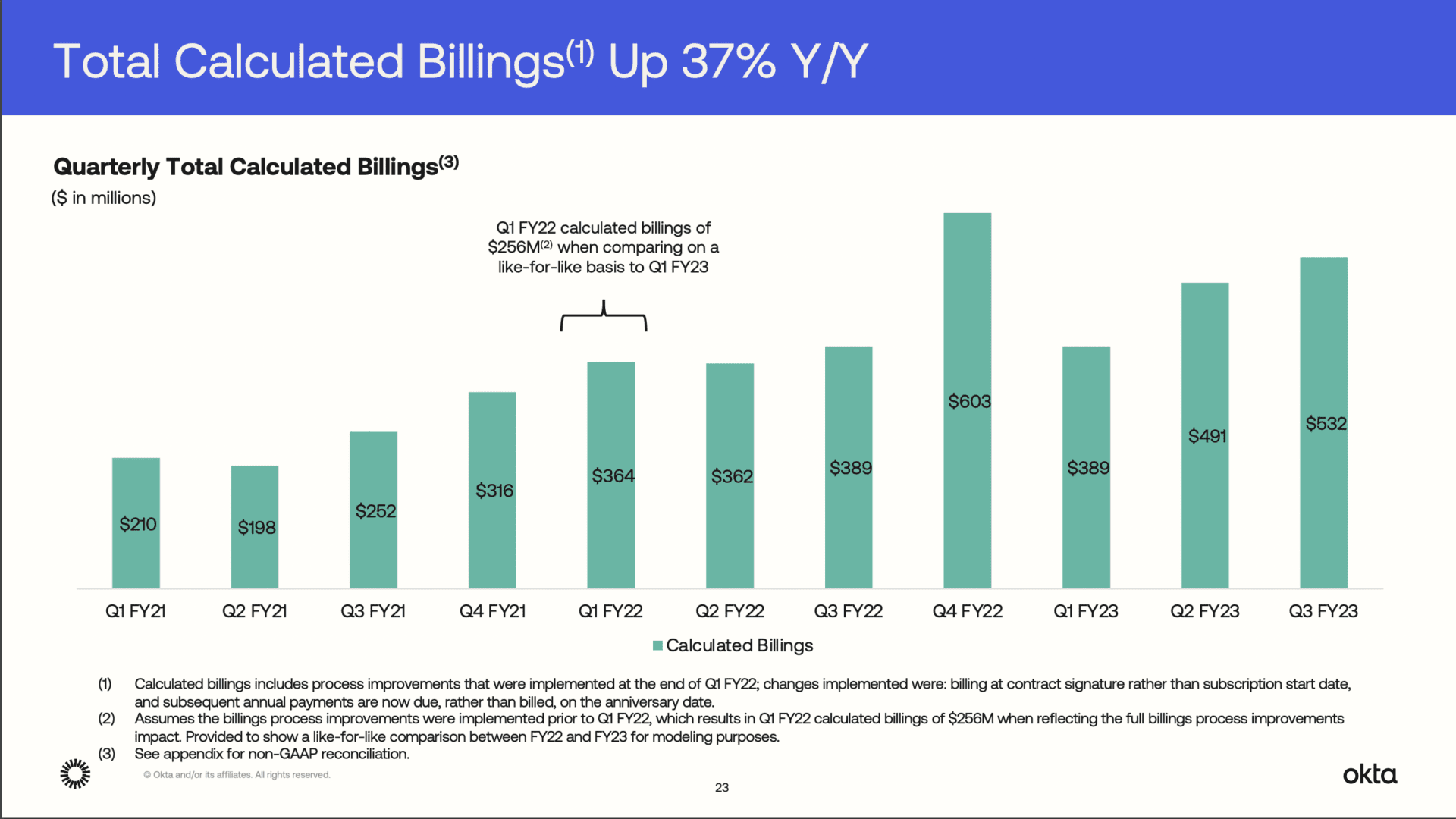

#5. Billings Much Lumpier Over Past 6 Quarters. Here’s where we can see a few bumps Okta hit — and why things are looking pretty darn good now. Billings peaked in their fiscal Q4’22, which really is about a year ago. When everything sort of peaking in SaaS. Then it quickly reverted to the same growth as before. And then the last two quarters, Okta re-accelerated:

So Okta is a great example of times still being pretty darn good in SaaS. But not as crazy good — probably too good — as they were a year ago.

And a few other interesting learnings:

#6. Customer Count Up 22%, While Revenues Up 37%. This is pretty much what you’d expect with 122% NRR or so, but it good to see the maths tie here. High NRR leads to revenue growing faster than your new customer count.

#7. $100k+ Customers Fuel Growth. The same was true at $1B ARR, but even more so at $2B in ARR. Their $100k+ customers are up 32% to 3,700 of the total base — versus 22% overall customer logo growth.

#8. Aiming for Profitability in CY’24. They aren’t there yet at $2B in ARR, and operating margins are fairly low. A reminder scaling SaaS takes real capital.

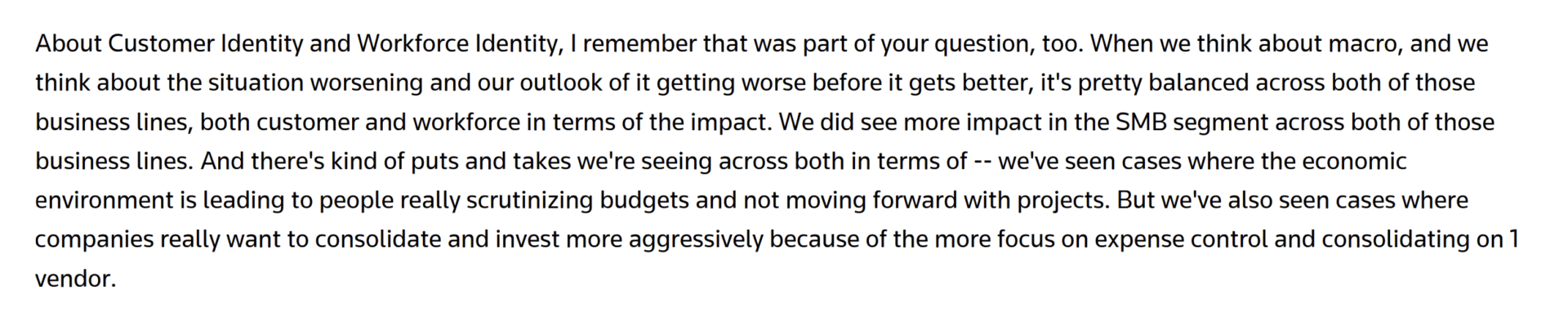

#9. Seeing both positives and negatives in current macro environment. Okta is seeing higher SMB churn and more ROI scrutiny, but is also benefitting from some customers wanting to centralize on fewer core vendors. And Okta isn’t seeing any deceleration in its biggest deals, the ones over $100k ACV.

#10. Slowing headcount growth — like lots of others. Okta headcount grew 32% year-over-year, fairly consistent with revenue growth, but then Okta like others slowed down hiring. It only grew 4.5% quarter-over-quarter.

#11. Average contract length of 2.5 years. An interesting tidbit. So presumably most bigger deals are 3 years, with some shorter deals.

Wow what a story!

And take a great look at the great session from Okta’s COO Frederic Kerrest on a Field Guide to Sales here from SaaStr Annual 2022: