So what’s going on with AE comp inflation? Everyone is looking for a higher OTE, and they’re often getting it. There are so, so many SaaS companies looking to hire AEs.

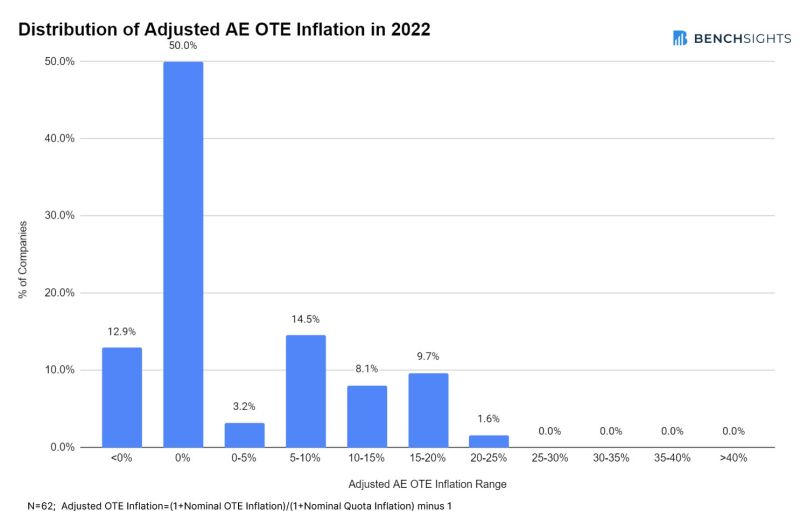

But what I’ve seen anecdotally, BenchSights now has data on: higher OTEs and OTE inflation is coupled with higher quotas.

Put differently, while OTEs are up 10%-15% on average year-over-year … so are quotas. So AEs are having to close more to justify their higher OTEs.

This isn’t necessarily a story that will end well. Because, all things being equal, it will lead to fewer reps hitting quota, which almost inevitably leads to less AE happiness, more turn-over, etc. Once you fall below the majority of reps hitting quota, it’s just plain demoralizing. A higher OTE tied to a higher quota often just makes it harder. The data confirms that OTE attainment almost has to drop with OTE inflation.

But startups are saying “OK, you can have your higher OTE. But you have to deliver to get it.” A bit of trading future success to solve present needs, today.

You probably have no choice but to match OTE inflation. If you “hold the line” here, your OTEs will look too low. But if your average rep has 110% or higher attainment, you can share with candidates their target comp that is even higher than the nominal OTE. That can help. Or you can have a “base” OTE and a stretch “OTE”, but that’s really too clever by half.

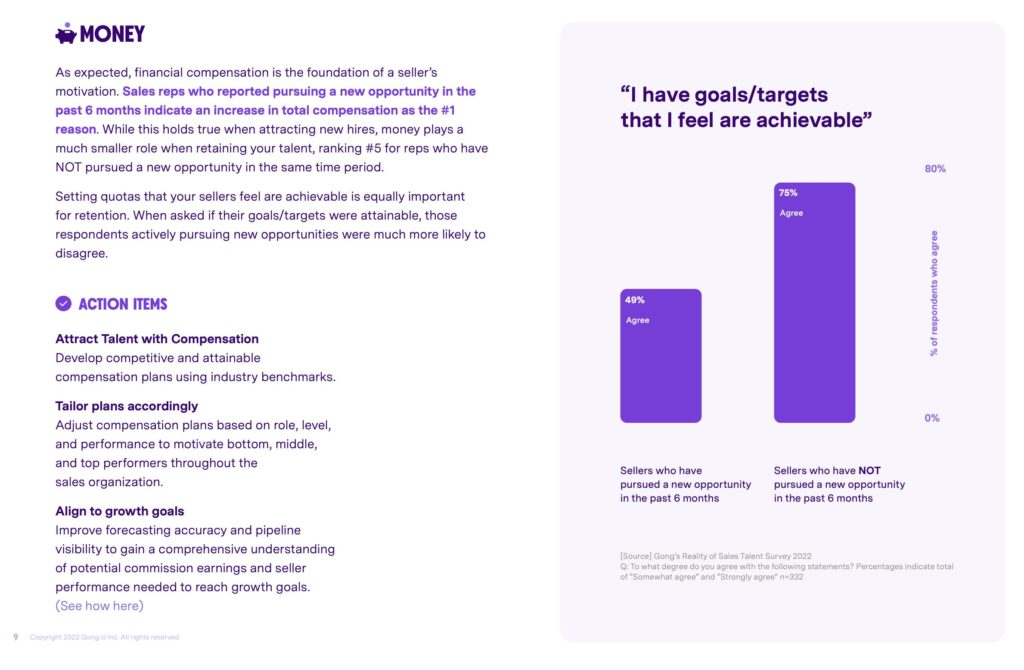

Gong has a recent report here that illustrates the challenge. Sales reps with achievable targets don’t look for a new job. Those that don’t meet they can meet their target … go looking:

Sign up here to get all the latest data from BenchSights.

And a deep dive with Sam Blond, CRO of Brex, on why you want 80% of your reps to hit OTE: