Dear SaaStr: Does the Fund Make The VC or VC Make The Fund?

SaaStr

MARCH 19, 2024

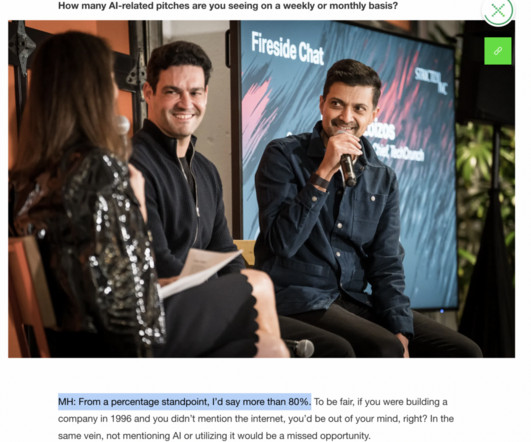

Dear SaaStr: Does the fund make the VC or VC make the fund? The VC makes the fund — but it’s a little more nuanced than that. If that’s so … how does a “great” fund help? Better Optimization of the Fund. The post Dear SaaStr: Does the Fund Make The VC or VC Make The Fund?

Let's personalize your content