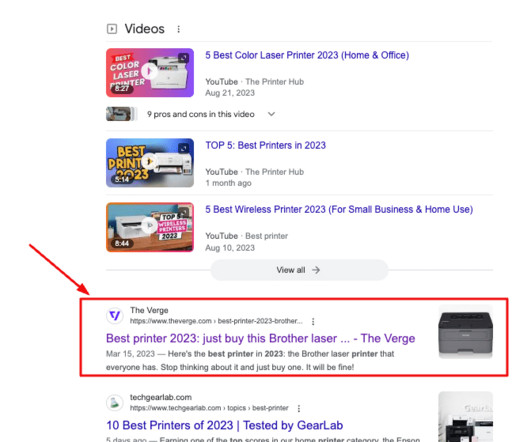

Reminder – Google is enforcing stricter rules for consumer finance ad targeting

Search Engine Land

FEBRUARY 27, 2024

Google will start enforcing tougher restrictions on personalized ads related to consumer financial products and services from tomorrow, February 28. Make sure your personalized ads comply with Google’s updated policy now, as this is your final opportunity before the new restrictions kick in. Why we care. What’s changing?

Let's personalize your content