There's no shortage of options if you're looking for money to start a business. Startup financing ranges from news-worthy venture capital rounds to credit cards, grants, and small business loans.

All entrepreneurs need to raise capital at some point — whether to get their business up and running or accelerate growth. But every lending choice comes with advantages and disadvantages. Some have long repayment terms and others require you to give partial ownership to investors.

Understanding your financing options is essential for success. You don't want to be one of the 38% of startups that fail because they ran out of cash or failed to raise new capital.

To help you find the financing that's right for your startup, we outline the various types of capital available to small business owners and share the steps to secure capital for your company—no matter the stage, age, or industry.

What is Startup Financing?

Startup financing is the capital that's used to fund a business venture. It's used for a variety of reasons, such as launching a company, buying real estate, hiring a team, purchasing necessary tools, launching a product, or growing the business.

Small business financing comes in many forms, but it all falls into two main categories: dilutive and non-dilutive financing. Dilutive financing requires an exchange of equity, or ownership, in the company, while non-dilutive financing allows founders to retain full ownership. For instance, an investor who gives money to a startup and gets shares in that company is considered dilutive financing. But a loan is non-dilutive because it doesn't require giving ownership in exchange for capital.

When choosing a financing option, you need to consider whether or not it will dilute your ownership and what kind of repayment plan is in place. Small business grants, for example, don't have to be repaid. But certain business loans require lenders to start payments as soon as they receive the money.

The world of startup financing can be complex, but what about startup funding? How does that impact a company, and what's the difference between the two?

Financing vs funding

On the surface, startup financing and startup funding appear to be one and the same. Most people use the terms interchangeably, but depending on who you're talking with, there's a slight difference.

Startup financing is the process of funding a business through equity financing or debt financing. Equity financing, such as money from a venture capital firm, doesn't need to be repaid because it offers capital in exchange for partial ownership. Investors risk repayment because they believe the company will be successful and their equity will one day be worth more than their initial investment.

Debt financing, such as opening a credit card, must be repaid. This type of financing includes interest as a way to repay the lending organization for its risk. Many startups use both equity and debt financing to fund their activities.

On the other hand, startup funding refers to the capital a business receives from lenders or equity holders, also known as capital funding. Still confused? Think of financing as the way to get capital (the method) and funding as the capital a company receives (the outcome).

So what are the financing options to fund your business? Let's walk through the most common sources.

Startup Financing Option

Entrepreneurs can take advantage of dozens of types of small business and startup financing models, but all these options boil down to three main ways to raise capital: by borrowing capital, issuing equity, or from net earnings.

1. Debt Financing

Companies can take on debt to finance their operations, just like people can take on debt to buy a house or pay for school. This can be done publicly through a debt issue or privately through an institution, such as a bank. Debt issues include credit cards, corporate bonds, mortgages, leases, or notes. Private debt financing mainly involves taking out a loan.

Just like you and I, companies that borrow money are responsible for paying the principal and interest to the lenders. They have to repay the creditors at a chosen point in the future, which could be within weeks or even years.

While interest is typically tax-deductible for companies, failing to repay lenders can result in bankruptcy or default. If this happens, it negatively impacts the borrower's credit rating and can make it difficult to raise capital in the future. That said, debt financing can be less expensive than net earnings or equity financing.

2. Equity Financing

Equity is the sum of shareholders' stake in a startup and represents the value of the business if all assets were liquidated and all debt paid off. Business owners can use this equity for financing by selling shares to outside investors in exchange for capital.

The investors become partial owners in the company and obtain voting rights, which allows them to weigh in on business decisions. The most common kind of equity financing comes from venture capitalists and private equity firms.

Since all shareholders own equity, they get a slice of future profits. This dilutes the ownership and overall control of the company — but that ownership also means you're not required to pay back investors' money.

You have time to build your business without the pressure of monthly payments. If your company goes bankrupt, investors lose out too. Just keep in mind that equity doesn't come with tax benefits and takes away part of your ownership, so it can be a more expensive form of financing.

3. Net Earnings Financing

The goal of every company is to make a profit. If a startup makes more money than it costs to run the company, it can use its earnings to fund other business activities.

Net earnings financing allows founders to grow a business or fund a new project without issuing equity or taking out debt. They can also use this money to reward investors and shareholders with dividend payments — or even buy back shares to regain ownership control.

In an ideal world, a startup would be able to use its revenue to invest in itself. The truth is, most companies need help to create a product or service worth selling.

While the net earnings model is the most cost-effective way to finance, it's usually not accessible to startups until they have a minimum viable product to sell. So let's look at how to get the funding you need to build a customer base, increase revenue, and become a financially independent business.

How to Get Financing For a Startup Business

Some startups need more financial help than others, so take the time to figure out what's best for your business. If you only need $50,000, don't take out a $100,000 loan and get stuck with excess interest and payments. Here are a few options for financing:

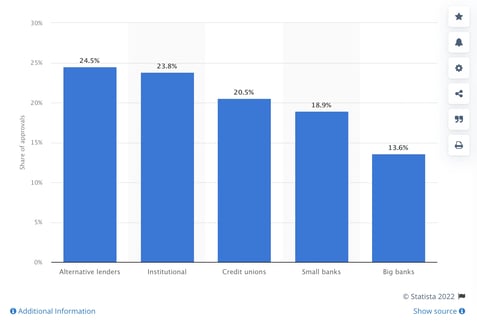

- Business term loan - A sum of cash that small business owners can borrow from banks, online lenders, or financial institutions. These loans come with fixed repayment terms, and 95% have fixed interest rates. The following chart by Statista shows the type of lenders that approved small business loans in Q2 of 2021.

- SBA loan - A government-backed loan with low-interest rates and variable funding amounts. In 2020, 30% of SBA microloans were issued to startups. All SBA loans have eligibility requirements, so make sure to check the organization's website to find the right option for your business.

- Business line of credit - A short-term loan that business owners can obtain without fixed repayment terms. It can range from $1,000-$250,000 and be used for rent, machinery, inventory, hiring, or other business expenses. In 2021, the Federal Reserve Bank delivered $44.8 billion in funding to small businesses through more than 61,000 loans. You can see the funding breakdown for minority-owned businesses here.

- Business credit card - Similar to a personal credit card, a business card can be used to make everyday purchases for your company. The credit limit is based on your financial history, as well as the company's financials, so you may have to work your way to a higher limit if you're just starting out. A major perk of a business card is getting points and rewards for business travel and expenses, which you can reinvest in your company.

- Equipment financing - Purchase the commercial fridge, machinery, or computer you need by making small monthly payments to lenders. Your business owns the equipment once you pay the full amount. Almost eight in 10 US companies use financing to purchase equipment, with 43% of financing coming from banks.

- Personal loan: A personal loan can be used to finance a business, but it's based on an individual's personal credit history. These loans range from $1,000 to $50,000 and are available from banks and credit unions. Keep in mind, a personal loan for business still impacts your personal credit score and savings, so make sure you can make payments on time.

- Crowdfunding - A crowdfunding campaign is where numerous backers give a company money in exchange for equity, an early-release product or service, or sometimes nothing at all. Platforms like Kickstarter, Indiegogo, and GoFundMe have successfully been used to finance startups. It's a low-cost method of raising capital since a failed campaign costs little time and money. But be wary of accepting money and failing to deliver results. Brands have ruined their reputations by the platforms by overpromising and under-delivering, which upsets a very important customer base.

Startup Financing Challenges

For most founders, fundraising isn't usually fun. It takes work to convince people that your business can be a success and time to figure out which financing option is best for your specific needs. Startup financing is even more challenging for minority business owners, who haven't been given equitable access to capital.

Once you have money in hand, the new challenge is making it last. Smart money management is essential to keep tabs on your cash flow, payment schedules, and dilution. Small business owners need accounting tools on top of sales and marketing software to help manage and build their companies.

Growth can't happen without capital, so financing has to be the top priority for new founders. But when you get it, do whatever it takes to avoid cash flow issues and build a business that lasts. A founder's ultimate goal is financial independence, and it's possible if you properly manage your funding.

![300+ Business Name Ideas to Inspire You [+7 Brand Name Generators]](https://blog.hubspot.com/hubfs/business-name-ideas_17.webp)