Amazon Ads for lead generation: What advertisers need to know

Explore lead gen opportunities for non-Amazon sellers, leveraging Amazon's vast audience insights and targeting options.

Amazon represents nearly 20% of U.S. search advertising share and $12 billion in ad revenue in Q3 2023 alone. If you sell on Amazon (or could sell on Amazon), odds are there’s an increasing chunk of ad spend being directed there.

While Amazon is synonymous with ecommerce, lead generation verticals are finally getting access to the platform’s second-to-none audience targeting. The campaigns are display-only (for now), but they still represent a huge opportunity for engagement.

In this article, we’ll delve into setting up Amazon ads, their unique appeal in this privacy-first world, and the significant shifts they bring to ad channel strategies.

Note: This piece was written while the Amazon non-endemic ad channel was in beta. As features emerge, we’ll strive to update this article accordingly.

What are Amazon non-endemic ads?

Amazon’s non-endemic ads grant non-Amazon sellers (i.e., lead gen advertisers) the opportunity to target Amazon’s audience. Currently, this ad channel supports:

- Travel.

- Automotive.

- Local services.

- Restaurants.

- Education.

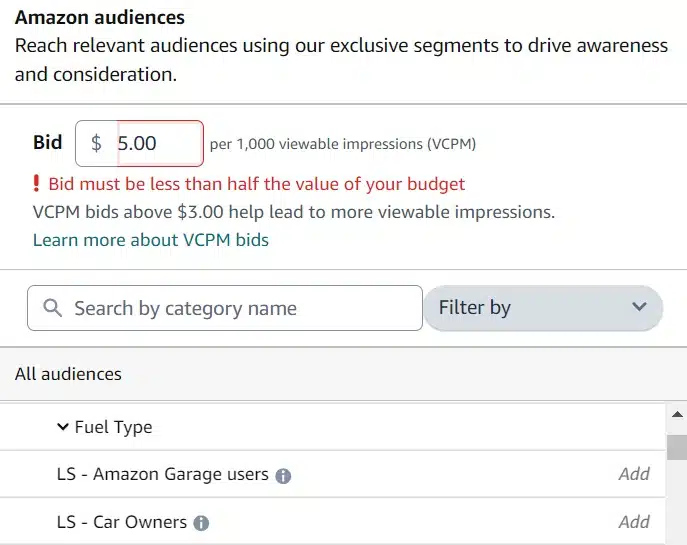

Advertisers define their bids at the audience level, pairing them with creatives set at the campaign level. Bids cannot surpass 50% of your daily budget. Additionally, the audiences you target will function as “or” statements.

For example, if you target “Users using Amazon Garage” and “Mazda cars,” you’ll set a bid for each. Your campaign will be eligible to target both (rather than users who meet both criteria).

I strongly suggest only adding multiple audiences to the same ad group if you’re truly OK with all audiences seeing the same creative. Otherwise, you will be served better by splitting them into separate ad groups.

Amazon provides an audience market share preview. This represents the total number, not a forecast based on your set budget.

Arguably, this is a more informative metric as it gives stakeholders a clearer understanding of the potential market.

These ads serve on Amazon and Amazon’s third-party network, which includes Twitch and IMDb.

Much like Google Display, you have the choice to pay per click or vCPM (cost per thousand impressions). Having tested both, I’d encourage those focused on actual engagement to opt for CPC, while those who are more interested in brand lift to opt for vCPM.

At the time of writing, location targeting is somewhat restricted. Despite this, you can target individuals, cities, states or entire countries. Notably, this solution is currently exclusive to the U.S.

- Important: The verification process is mandatory. Amazon has incorporated this as a protective measure for both advertisers and consumers.

Why is this channel interesting?

If you’re a Google-first or paid social lead gen brand, Amazon’s model might seem like it’s coming out of left field. Amazon’s audiences are at the heart of its offering.

As the privacy-first web has forced ad channels to innovate, Amazon has built-in protections to future-proof its audiences.

The platform offers incredibly detailed audience insights without targeting specific individuals, instead focusing on in-depth cohorts. These cohorts can be based on:

- Viewing specific products.

- Engaging with Amazon technology/subsidiaries (i.e., Whole Foods)/

- Purchasing patterns.

Some verticals get incorrectly flagged by Google Ads and Meta Ads.

For instance, some advertisers are flagged as financial services merely because they mention no credit required.

Auto gets hit with this a lot, which is why it’s unsurprising Amazon is choosing to focus on it.

Additionally, local services that are on the line (like lawyers and wellness centers) have a much easier time than on Google or Meta. This is due to the specific product focus vs. ideas people look for.

The best way to think of this channel is as incremental ad spend and volume.

If you’ve allocated 10-15% of your budget for experimental campaigns, Amazon ads are an excellent fit.

If visual content campaigns have been straining your budget, this channel might help regain control and target more deliberately.

Setting up Amazon campaigns

Clearing the verification process is pivotal to the setup. Once that’s achieved, the subsequent steps are pretty straightforward. Ensure you register with your company’s official legal name.

If you are setting up the account on behalf of a client, make sure you build in time for them to enter payment information. Otherwise, the billing profile behaves much the same as on other networks.

Note that you will not be able to save/start your campaigns until you have billing information added.

The majority of the campaign work is tied to creative and audience selection.

Creative can either be made through Shutterstock images or by uploading your own. Note that there is limited editing functionality, so you’ll need to add the images in the correct sizes.

Note that part of your creative will be written text. Treat this like a long headline from Google Display (90 characters).

Once you have your creative, you can pick your audiences. You’ll be able to manually select them, or search. Note that you won’t be able to add them to your campaign and get audience size forecasts if your bid exceeds 50% of your daily budget.

Campaigns can be configured to go after leads (only conversion event is available now), views or clicks. Depending on which you choose will determine whether you’re set up for CPC or vCPM.

Why non-Amazon sellers should consider Amazon Ads

Amazon has built one of the best audience pools available on the market. While the campaigns are display only for now, they still represent a massive opportunity for those trying to reach more challenging cohorts of people.

While all verticals they support are interesting, the biggest opportunity will be for:

- Auto due to the integration with Amazon Garage.

- Local services that can benefit from product purchase patterns.

Dig deeper: 5 reasons Amazon Ads is better than Google Ads for ecommerce

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories

New on Search Engine Land