So we’ve been saying for a while that the back half of 2024 could be good for SaaS IPOs, we just needed a few of the break-out winners to IPO to get the engine rolling again. The SaaS IPO window really closed in late 2021 with HashiCorp as the last great one to IPO in December 2021.

And now we have that first great IPO filing since 2021 — Klaviyo.

The Next Great SaaS IPO is officially coming:@klaviyo

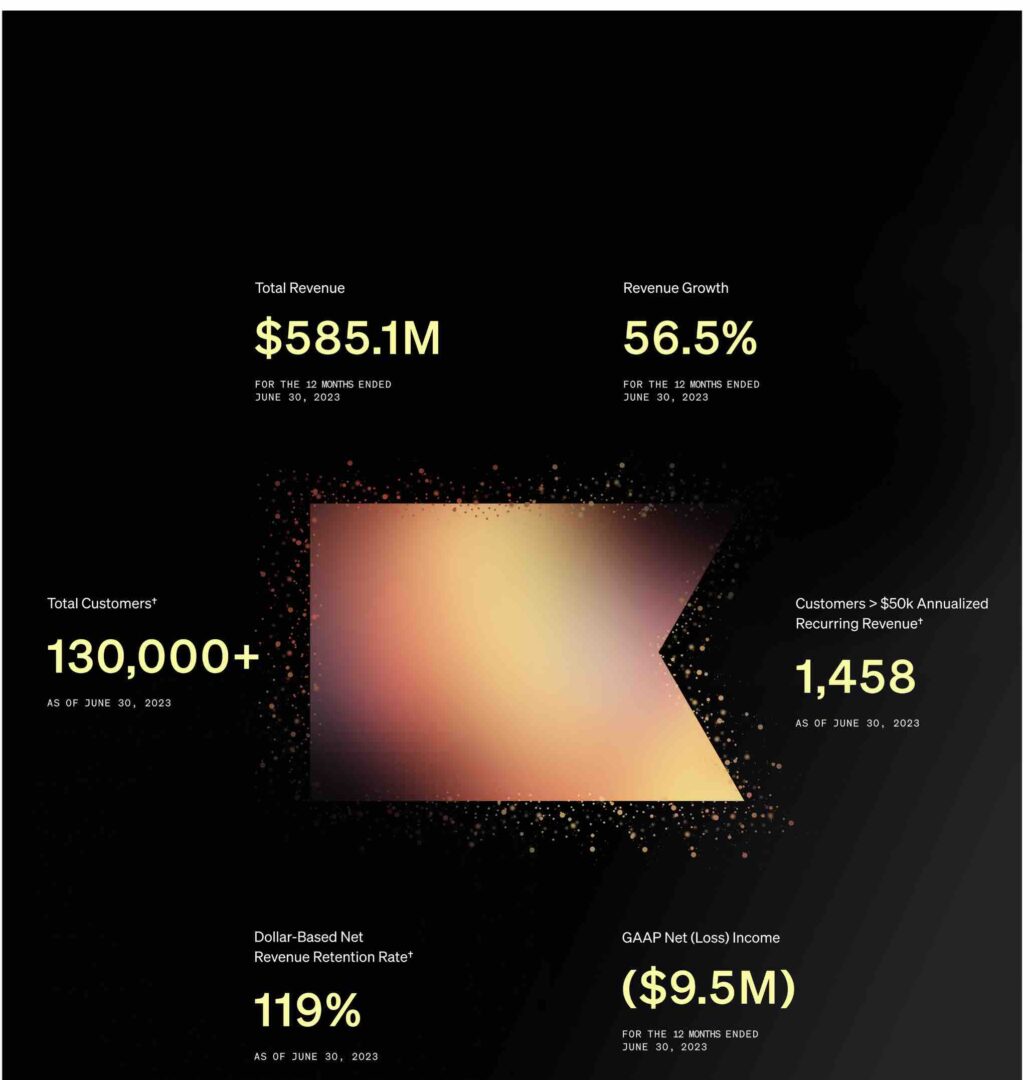

▶️$585m ARR

▶️57% Growth (boom!)

▶️ 119% NRR

▶️ Profitable last 6 mos, almost last year (Efficient!) pic.twitter.com/Sg9rMkIEoh— Jason ✨Be Kind✨ Lemkin (@jasonlk) August 25, 2023

You may not have heard of Klaviyo if you are outside of e-commerce, but in the e-comm world, it’s the #1 B2B player. It dominates the Shopify marketing ecosystem and others as well.

And it’s got the full package:

- True Scale: Almost $600m ARR

- Epic Growth: Still growing 57% at $600m ARR — wow!

- Top Tier NRR: 119%

- Profitable: Klaviyo has gotten leaner, and has been profitable the past 6+ months.

There’s nothing to knock here, folks. And … it was essentially incredibly capital-efficient as well. Borderline bootstrapped (more to come here on SaaStr). They only burned $15 million to get to $585m in ARR and an IPO filing!

“Since we were founded in Boston, Massachusetts by Andrew Bialecki and Ed Hallen, we have been able to reach significant scale, with revenue of $472.7 million for the year ended December 31, 2022. Efficiency is part of our DNA. We have raised $454.8 million in primary capital since our inception, of which we have utilized only $15.0 million in the operation of our business as of June 30, 2023, which is net of the $439.8 million of cash, cash equivalents, and restricted cash on our balance sheet as of June”

This is the break-out IPO the markets need to get the engine going again. Not ARM, or Cava. No, we need a great SaaS IPO, with strong unit economics, high NRR, and that is efficient.

Klaviyo has it all. Wow.

And a deep dive with CEO Andrew Bialacki here: