Many of the fundamental business models that were once engraved in the SaaS playbook are now changing thanks to a tougher macro environment and a maturing market.

In last week’s Workshop Wednesday, held every Weds at 10 a.m. PST, Stephanie Opdam, Partner at Notion Capital, shares four business model changes that will allow SaaS companies to build resilience and staying power over time.

Some of the changes we’ve seen in the last year or two include:

- CAC reduction

- Headcount optimization

- Price complexity

- Quality of revenue

A different environment means a different strategy, and Notion Capital lays out four business model changes that could be helpful based on what peers are doing.

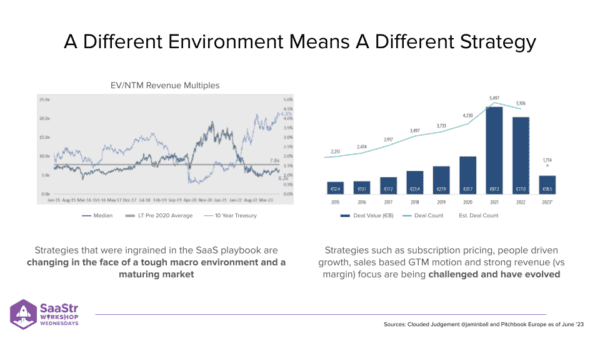

A Different Environment Means A Different Strategy

The left chart shows big valuation increases, lots of LP money available, and an overall abundance of capital.

Then, we saw a correction happen with fears of a recession and rising interest rates.

Now, the lows appear to stabilize around the levels we saw in 2016. Many believe this is the bottom, and over time, things will go up.

The right-hand graph shows that deal count and overall investments have fallen.

The actual numbers might not be as bad as the graph shows, but companies that will need to go out and raise from external investors within the next 12 months will need to grow much faster to counter the effect of a multiple decline.

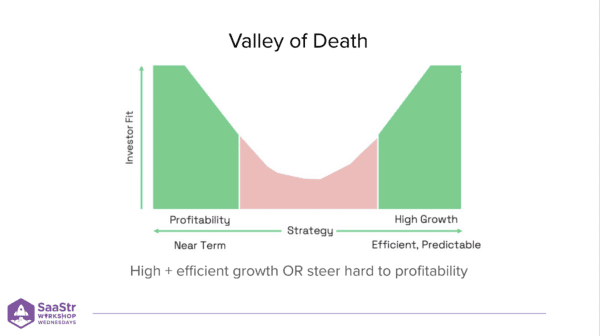

The Valley of Death

This Valley of Death graph shows quite a clear division in the market.

On the one hand, you might be growing very fast, and you’re relatively efficient. Those people are sitting pretty on the right-hand side of the graph, and it’s a great place to be.

It’s also acceptable to dial it back a bit and wait for better times. Those people are steering to the left-hand side.

You’re in trouble if you’re sitting in the middle of the valley of death.

This is where traditional SaaS methods like subscription pricing only, driving growth through headcount only, or a pure sales GTM strategy only live.

You don’t want to be there.

Those methods no longer work, and it’s time to adapt.

Keep reading to learn what changes your SaaS company can adopt to stay relevant in today’s environment.

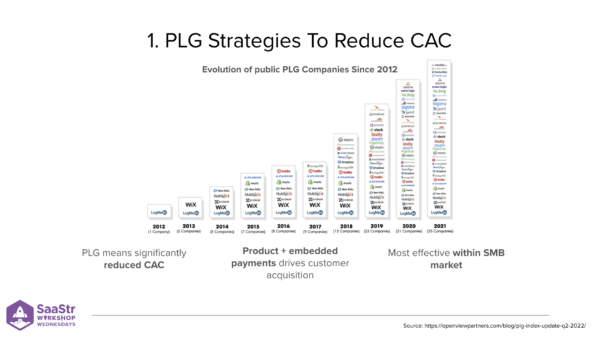

Change #1: A Very Clear Uptick In Product-Led Growth Strategies

If you look at Notion Capital’s Cloud challengers, 35% are working on a PLG growth strategy.

PLG is about investing in product and data instead of sales and marketing.

What does PLG bring to the table?

- It shows you optimized onboarding for customers

- A low entry point, whereas traditional sales-based strategies require hiring sales teams, sales collateral, and a longer ramp-up time

- PLG significantly reduces CAC

- Product and embedded payments drive customer acquisition

If you spend more time on a PLG strategy, you could save a lot of costs.

The broader data available shows that companies are 70% more likely to break even within two years of profitability and 2x more likely to reduce CAC costs.

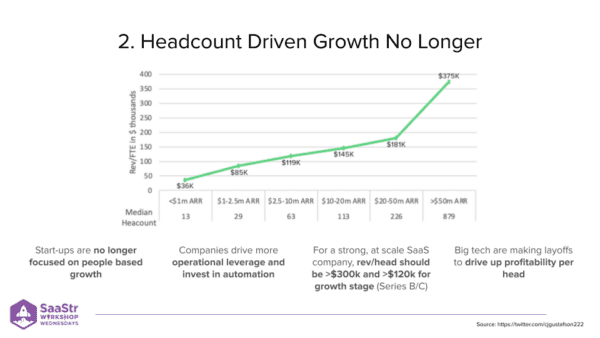

Change #2: Headcount Driven Growth Is No Longer

Since the start of 2020, companies have focused on more than just revenue per head. They’re also paying attention to profitability per head.

It’s hard to measure if you don’t have profitability, but the Cloud Challengers are growing their headcount in a range of 0-33%, which is astonishingly low for a tech startup.

Digging further, companies optimize for any person they bring into the organization. Those people should be able to generate revenue in the next 6-12 months, whether commercial or product-facing.

The likes of Microsoft, Salesforce, and Meta have all done major layoffs in the last year.

Apple hasn’t done any.

They don’t have the highest revenue per head, but they certainly have the highest profitability.

Notion Capital came up with a benchmark for the days when you’re below $20M ARR.

Strive for $150k of revenue per FTE.

Your largest cost space is people, so align yourself with a number of FTEs that are directionally correct.

Ask yourself, “Who am I hiring for the next position, and can they contribute to this number in a meaningful way after the ramp-up period?”

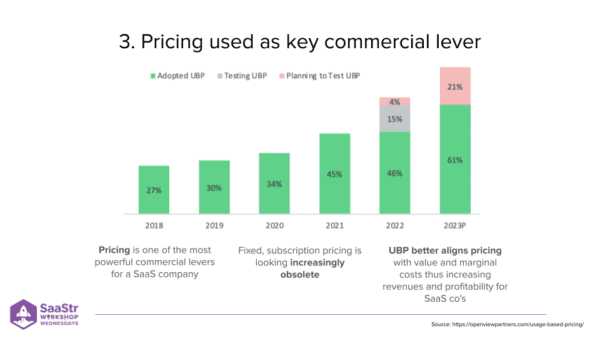

Change #3: Use Pricing As A Key Commercial Lever

“The SaaS subscription model has been treated as a sacred cow for a long time,” says Opdam.

Assuming all renew and you sign new ones, it has a nice exponential effect, and it’s sticky.

Then, usage-based pricing took off.

22% of Cloud Challengers are doing purely usage-based pricing models. An overview of data found that nearly 61% of companies used only usage-based pricing.

That number is expected to jump to 81% in the next two years.

Opdam doesn’t suggest switching to a pure usage-based pricing model because you might get too much fluctuation.

The most successful portfolio companies have a SaaS+ model — a fixed subscription base and a revenue overlay based on usage.

The takeaway:

It’s worth letting go of the belief that subscription-based pricing models are the only way.

But don’t go to the other extreme. Find something valuable in the middle.

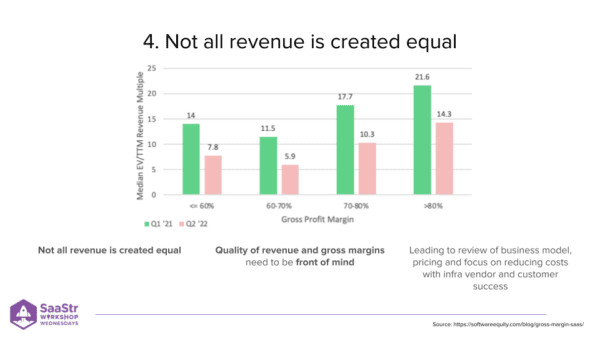

Change #4: Not All Revenue Is Created Equal

At Notion, they held a rule of thumb that companies shouldn’t spend more than 10% of revenue coming from professional services like implementation.

Another huge cost of goods or sales is Cloud spend.

41% of total IT budgets for many companies is on Cloud costs.

If you can optimize Cloud costs, and many have already optimized for professional services, you can get a 10% increase in your gross profit margin.

The multiple you can get on your company is quite astonishing.

Reducing Cloud spend is a quick and easy way to demand between a 14-20x multiple because you can show how efficient you are.

How do you reduce Cloud spend?

There are a couple of ways.

- Utilize a free spend view tool combined with the usage of reserved instances rather than paying bulk.

- Enter with brokers in a pay-as-you-go agreement or under-utilization insurance that can guarantee you get a cash payback if you under-utilize your instances.

Key Takeaways

SaaS is growing up. If you can make these adaptations and optimizations, you not only create more longevity because you optimize the biggest part of your cost, but you also drive a little more revenue around things like pricing.

If you can make small variations and optimize for that, the heaviest users will pay more, and new customers can enter at a lower level.