Whether you’re a startup founder, a product manager, or an investor, understanding how to find total addressable market is crucial for your strategic planning. According to industry experts, the ability to accurately calculate your Total Addressable Market (TAM) can significantly influence your business’s growth trajectory.

This key metric provides invaluable insight into the potential revenue opportunities available in your chosen market segment. However, with various calculation methods and factors at play, how do you navigate this complex process?

In this guide we will demystify the concept of TAM and provide practical steps on how to effectively determine it. Let’s delve into proven strategies that will help you accurately identify your total addressable market and utilize these insights for informed decision-making.

A solid grasp of ‘how to find total addressable market’ not only aids in setting realistic goals but also helps in attracting investors by showcasing potential returns on their investment.

Table of Contents:

- Unraveling the Concept of Total Addressable Market (TAM)

- Approaches to Calculating Total Addressable Market

- The Impact of TAM Analysis on Business Decisions

- Mastering Your Total Addressable Market Calculation

- Case Studies Illustrating Effective Use Of Total Addressable Market Analysis

- FAQs in Relation to How to Find total Addressable Market

- Conclusion

Unraveling the Concept of Total Addressable Market (TAM)

In business, understanding your total addressable market (TAM) is key to unlocking potential revenue opportunities.

The concept of TAM represents all selling opportunities within a specific market or industry for an organization’s product or service.

This includes every possible customer who might find value in what you’re offering and could potentially contribute to your company’s total revenue.

The Role of TAM in Business Planning

Determining the extent of your TAM is a lot more than just crunching figures – it’s about strategic planning and decision-making.

TAM analysis drives results by calculating how much effort, resources, and funding are needed to capture different subsets within the target market.

Remember that while estimating TAM gives us an idea about our maximum available reach under ideal conditions; we should also consider other factors like competition level, company size etc.

A well-calculated estimate can help businesses prioritize their go-to-market strategy effectively align with high-value segments.

Accurately calculating TAM can enable businesses to maximize their return on investment and remain competitive in the ever-evolving markets.

We’ve now begun unraveling the importance of accurately calculating tam for any business model looking at capturing significant shares from its respective markets. Let’s dive deeper into various approaches used for measuring this crucial metric next.

Approaches to Calculating Total Addressable Market

The process of calculating your total addressable market (TAM) can be approached in several ways.

Each method has its unique strengths and potential drawbacks, depending on the specifics of your business model and target market.

Top-Down Approach for Estimating TAM

This approach involves starting with a broad overview of the entire market today before narrowing down into more specific subsets relevant to your product or service.

Third-party data, or even governmental statistics often serve as valuable sources for this information.

Note that while it provides an expansive view, accuracy may sometimes take a hit due to reliance on external data which might not fully align with one’s niche segment.

Bottom-Up Approach for More Accurate Estimation

In contrast, the bottom-up approach is built upon granular first-party data like current pricing structures and usage rates among existing customers. This allows you to extrapolate outwards based on actual sales figures rather than estimates from larger industry trends.

A key advantage here is precision; since calculations are grounded in real-world customer behavior within their own company size category, revenue opportunities tend to be forecasted more accurately.

Value Theory Approach – Understanding Customer Value

Last but certainly not least comes value theory: estimating TAM by gauging what customers would willingly pay for certain benefits provided by products/services similar to yours.

This technique requires deep insights into consumer preferences – both rational economic factors such as price sensitivity & emotional aspects like brand loyalty – making it highly useful when crafting go-to-market strategies tailored towards maximizing perceived client satisfaction.

The Impact of TAM Analysis on Business Decisions

Understanding your total addressable market (TAM) is more than just a number crunching exercise.

It’s an essential part of strategic business planning that can influence everything from budget allocation to investment decisions and go-to-market strategy.

Utilizing TAM Calculation for Financial Forecasts

A well-executed TAM analysis drives results, calculating the potential revenue opportunities available in your specific target market.

This information serves as a foundation for financial forecasts, helping businesses predict their possible earnings if they were able to capture 100% of the identified market share.

Beyond providing insight into prospective revenues, it also helps identify areas where you might need additional resources or adjustments in your business model. This article provides further insights into how understanding this metric can shape future growth strategies.

In essence, knowing the size of your serviceable obtainable market allows you to make informed decisions about which markets are worth pursuing and what kind of investments those pursuits may require.

Your company size plays a role too; smaller companies with limited resources might focus on niche segments within larger markets while bigger corporations could aim at capturing significant portions across multiple subsets within the same industry. Calculating Tam accurately gives clarity around these choices by quantifying potential customers‘ base and associated revenue opportunity. It’s not only useful internally but also externally when trying to attract investors or justify valuations during funding rounds. Investors often look at Total Addressible Market figures when assessing whether there’s enough room for substantial returns on their capital injection.

If calculated correctly using accurate data sources such as customer surveys or third-party research reports like Gartner’s Magic Quadrant series, then having robust knowledge about one’s total tam becomes an invaluable tool guiding many aspects related directly towards achieving success in today’s competitive marketplace scenario. Now let us move forward exploring practical tips surrounding effective calculation methodologies ensuring accuracy while estimating our own organization-specific Total Addressible Market sizes next.

Key Takeaway: Understanding your total addressable market (TAM) is crucial for strategic business planning. It helps determine budget allocation, investment decisions, and go-to-market strategy. Accurately calculating TAM provides insights into revenue opportunities and guides growth strategies. It also influences resource allocation and attracts investors.

Mastering Your Total Addressable Market Calculation

If you’re looking to accurately calculate your total addressable market (TAM), understanding the right approach is crucial.

This knowledge can significantly influence your go-to-market strategy and revenue opportunities.

Avoiding Common Mistakes While Calculating TAM

The first step towards mastering TAM calculation involves recognizing common pitfalls.

Mistake one: overlooking specific market subsets when estimating potential customers, which could lead to an inflated or deflated view of the total number of prospects in a given target market.

To avoid this, ensure that you’ve thoroughly analyzed all relevant segments within your industry before calculating TAM. Investopedia’s guide on TAM provides excellent insights into segment analysis for accurate calculations.

Mistake two: neglecting company size while considering business opportunities. Remember, not every organization will be suitable for your product or service due to factors like budget constraints or operational capacity.

You should take these aspects into account during TAM calculation as they impact overall demand levels and thus affect total revenue estimates.

Last but not least, mistake three: assuming static conditions over time – markets evolve. So does their size and composition.

Your initial estimate might become outdated if it doesn’t factor in future trends affecting customer behavior or competitive landscape changes; therefore always consider conducting periodic reviews using updated data sources such as Statista, a renowned portal providing access to recent statistics from various sectors globally.

With these tips at hand, you’ll certainly enhance accuracy when calculating Total Addressable Market armed with robust methodologies, and hence better position yourself in today’s dynamic marketplace.

Case Studies Illustrating Effective Use Of Total Addressable Market Analysis

In the world of business, nothing speaks louder than real-world examples.

Let’s dive into some case studies where companies have effectively leveraged total addressable market analysis to steer their strategies and decisions towards success.

A Tech Startup’s Journey with TAM

An emerging tech startup was looking for ways to penetrate a specific market segment. They decided to calculate their TAM using both top-down and bottom-up approaches.

The top-down approach, leveraging industry reports, gave them an estimate of the overall potential revenue in that sector. The bottom-up method helped identify how much they could realistically capture based on factors like product pricing, customer acquisition cost, company size etc.

This dual-pronged strategy provided valuable insights about potential customers and competitors alike – helping them refine their go-to-market strategy accordingly.

Gaining Market Share through Accurate TAM Calculation

A consumer goods company used detailed total addressable market calculations as part of its growth plan. By understanding its serviceable obtainable market (SOM), it was able to prioritize resources efficiently – focusing more on markets offering higher return potentials while maintaining competitive prices without compromising profits.

The results? A significant increase in sales figures over subsequent quarters.

TAM Driving Strategic Decisions at a B2B Company

A B2B software firm utilized value theory-based calculation methods for estimating its total addressible market. This allowed them not only gauge the worthiness of entering new verticals but also understand what aspects were most valued by prospective clients within those sectors.

Armed with this knowledge, they crafted targeted solutions which led to increased adoption rates among identified prospects resulting in greater revenue opportunities.

Remember: these are just illustrations; every organization has unique circumstances dictating suitable methodologies when calculating tam or interpreting findings thereof.

Your goal should be identifying one that aligns best with your own situation ensuring maximum accuracy during estimation process thereby driving strategic decision-making forward successfully.

Unveiling the Power of Total Addressable Market Analysis

Real-world case studies demonstrate how businesses have harnessed total addressable market analysis to drive success. From tech startups calculating TAM using top-down and bottom-up approaches, to consumer goods companies prioritizing resources based on SOM, and B2B firms utilizing value theory-based methods – these examples highlight the importance of accurate TAM calculations in strategic decision-making. Remember, every organization is unique, so find a methodology that aligns with your circumstances for maximum accuracy and success.

FAQs in Relation to How to Find total Addressable Market

What is an example of a total addressable market?

The total addressable market for smartphones, for instance, would be all individuals worldwide who could potentially purchase and use a smartphone.

How do you calculate TAM from SOM?

SOM (Service Obtainable Market) is typically a subset of the TAM. To get the TAM from SOM, divide your company’s revenue or unit sales by its market share in that segment.

What is an example of a TAM?

An example of Total Addressable Market (TAM) might be the entire global coffee industry if you’re launching a new brand of coffee beans.

What is the formula for total market size?

Total Market Size can be calculated as: Number of potential customers x Average annual revenue per customer. This gives an estimate on how much revenue could theoretically be generated in this market.

Conclusion

Unraveling the concept of Total Addressable Market is like finding a compass in the business world. It’s your guide to potential revenue and opportunities.

The different approaches – top-down, bottom-up, or value theory – are your tools for this journey. Each has its own strengths and nuances.

Remember, calculating TAM isn’t just about numbers. It’s also about understanding customer behavior and preferences.

TAM analysis impacts key business decisions; it guides budgeting strategies, investment plans, and even helps attract investors by showcasing potential returns.

Avoid common mistakes while calculating TAM to ensure accuracy because precision matters when you’re charting out your growth strategy!

In essence, knowing how to find total addressable market is a game-changer for businesses looking to scale up effectively and efficiently.

Need Help Automating Your Sales Prospecting Process?

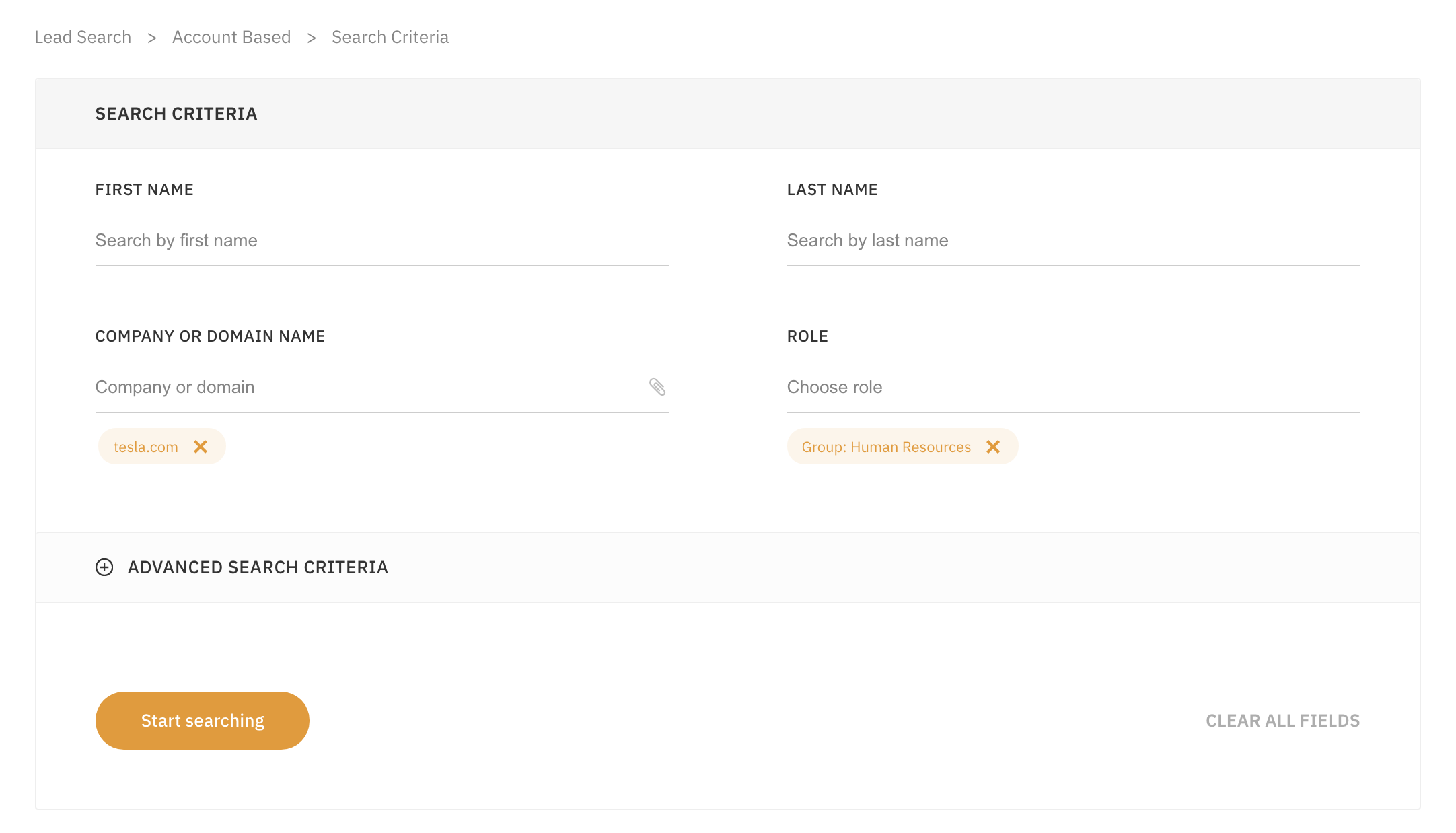

LeadFuze gives you all the data you need to find ideal leads, including full contact information.

Go through a variety of filters to zero in on the leads you want to reach. This is crazy specific, but you could find all the people that match the following:

- A company in the Financial Services or Banking industry

- Who have more than 10 employees

- That spend money on Adwords

- Who use Hubspot

- Who currently have job openings for marketing help

- With the role of HR Manager

- That has only been in this role for less than 1 year

Or Find Specific Accounts or Leads

LeadFuze allows you to find contact information for specific individuals or even find contact information for all employees at a company.

You can even upload an entire list of companies and find everyone within specific departments at those companies. Check out LeadFuze to see how you can automate your lead generation.

Want to help contribute to future articles? Have data-backed and tactical advice to share? I’d love to hear from you!

We have over 60,000 monthly readers that would love to see it! Contact us and let's discuss your ideas!