Whether you’re a startup founder, a marketing manager, or an eCommerce business owner, understanding how to calculate customer acquisition cost is crucial for your success. According to industry data, companies that accurately track and manage their Customer Acquisition Cost (CAC) tend to have better control over their budget allocation and overall profitability.

This key metric provides invaluable insights into the effectiveness of your marketing strategies. However, with so many variables at play in calculating CAC – from advertising expenses to salaries – how can one ensure accurate calculations?

In this guide, we will break down the steps on how to calculate customer acquisition cost effectively. We’ll also delve into ways of reducing it without compromising product quality or service standards.

Let’s demystify this critical business metric together and help position your company for sustainable growth.

Table of Contents:

- Understanding Customer Acquisition Cost (CAC)

- The Importance of CAC in Business Strategy

- How to Calculate Customer Acquisition Cost

- Comparing CAC to Key Business Metrics

- Strategies for Reducing Customer Acquisition Cost

- Case Studies on Customer Acquisition Costs Across Industries

- Navigating Challenges in Reducing Customer Acquisition Costs

- FAQs in Relation to How to Calculate Customer Acquisition Cost

- Conclusion

Understanding Customer Acquisition Cost (CAC)

The concept of Customer Acquisition Cost, or CAC, is a crucial business metric that any marketer, sales rep, recruiter, or small business owner should understand.

This measurement encapsulates the total costs associated with acquiring new customers for your company.

In essence, it’s an aggregate figure that includes various expenses such as marketing and advertising costs. Investopedia.

It also factors in employee salaries directly linked to customer acquisition efforts like those from your dedicated sales team.

A Look at Production Costs

Production costs, another component of CAC calculation, are equally important to consider when understanding this key metric.

This can include everything from creating product samples for potential clients to inventory upkeep needed during the sales cycle.

Capturing Other Expenses In The Customer Journey

Beyond these obvious expenditures lie other less apparent but nonetheless critical components involved in acquiring customers.

These could range from software subscriptions used by your marketing teams to paid advertising on social media platforms. HubSpot.

All these elements combined give you a comprehensive picture of how much money is spent towards adding each new client into your customer base.

To make informed decisions about where best allocate resources within their companies, successful businesses need to be aware of the average lifetime lifespan paying so they can calculate CAC effectively, improve profit margins, and reduce overall expenditure. In the next section, we’ll dive deeper into why exactly such an essential aspect of strategy. Stay tuned.

The Importance of CAC in Business Strategy

Understanding your customer acquisition cost (CAC) is crucial for any business, particularly startups and small businesses.

This vital metric gives you insight into the total costs associated with acquiring new customers – a key factor in evaluating the effectiveness of your marketing efforts.

Evaluating Marketing Efforts

By accurately calculating your CAC, you can assess whether or not current strategies are paying off.

If it’s high compared to industry averages, this could indicate that more money is being spent than necessary on advertising campaigns or sales team initiatives.

Making Informed Decisions

A thorough comprehension of customer acquisition expenses permits entrepreneurs and advertisers to settle on educated choices regarding where assets ought to be designated.

“A company’s profitability depends not only on having good profit margins but also on consistently reducing its customer acquisition cost.”

Varying Costs Across Industries

CAC isn’t static; it varies across industries.

Different sectors have different average customer lifespan values which impact their respective average CACs.

To benchmark against others in your field effectively, HubSpot suggests comparing yours with competitors’ data if available.

How to Calculate Customer Acquisition Cost

The process of computing your CAC (customer acquisition cost) is a vital step in gauging the efficacy and proficiency of your marketing strategies.

This business metric provides insights into how much you’re spending on acquiring customers, including production costs, employee salaries, advertising costs, and more.

Choosing the Time Period for Calculating

Selecting a specific time period when calculating CAC ensures consistency and accuracy in your calculations. This could be quarterly or annually depending on what best suits your business model. [Investopedia].

Types of Costs Included in CAC Calculation

Including all relevant expenses gives an accurate representation of total costs associated with attracting new customers. These include ad spend (HubSpot), technical support services fees (Zendesk), publishing charges (The Content Authority), as well as inventory upkeep expenses (QuickBooks Canada).

In addition to these direct expenditures are indirect ones such as money spent on maintaining sales team operations.

To calculate this key SAAS business indicator:

- Add up all marketing spend over selected time frame,

- Tally up any additional expenditure incurred during that same period,

- Last but not least divide by number of paying customers acquired within that span.

This will give you average customer acquisition cost per client which can then be used for future planning purposes.

Remember though each industry has its own norms so it’s always wise to compare against similar businesses wherever possible.

Now let’s move onto another important aspect: comparing our calculated CAC with other crucial metrics like CLV (Customer Lifetime Value).

Comparing CAC to Key Business Metrics

In the realm of commerce, assessing your CAC (customer acquisition cost) alongside key metrics like CLV (customer lifetime value) is essential.

Understanding LTV-to-CAC Ratio

This comparison forms a ratio known as the LTV-to-CAC ratio. This essential business metric helps determine profitability and assesses how well marketing efforts are paying off.

No need to worry if these terms are unfamiliar. The CLV represents the total revenue a company can reasonably expect from a single customer throughout their relationship with that customer. On the other hand, CAC refers to all costs incurred while acquiring this new client – everything from ad spend to employee salaries and production costs.

The ideal scenario for any SaaS business or startup is having an LTV significantly higher than its CAC — indicating strong return on investment in acquiring customers.

A high CLV compared to CAC means each dollar spent on attracting clients results in multiple dollars earned over time—a clear sign of successful marketing strategies at work.

Generally speaking, an excellent LTV-to-CAC ratio ranges between 3:1 and 4:1.

Remember that understanding this balance doesn’t just help gauge past performance—it also aids future planning by providing insights into where resources might be best allocated within sales cycle stages.

Strategies for Reducing Customer Acquisition Cost

In the competitive world of business, finding ways to reduce customer acquisition cost is crucial.

This can be achieved by optimizing ad spend and improving ad creative quality among other strategies.

Optimizing Ad Spend

To acquire customers without breaking the bank, you need to optimize your marketing spend wisely.

The goal here isn’t just about spending less on ads but getting more value from each dollar spent.

Improving Ad Creative Quality

Apart from managing your budget effectively, another strategy involves enhancing the quality of your advertising creatives.

Your aim should be creating compelling advertisements that not only grab attention but also resonate with potential customers’ needs or interests.

If executed correctly these strategies will help improve customer acquisition costs which leads us onto our next topic: case studies across various industries showcasing their approach towards this important metric.

Case Studies on Customer Acquisition Costs Across Industries

Different industries approach customer acquisition cost (CAC) management in diverse ways.

Gaining knowledge of these distinctions can supply advantageous understanding into your own business tactics and assist in refining your advertising attempts.

The SaaS Business Model

In the SaaS field, CAC has a major effect.

Sales teams often face long sales cycles which can increase total costs of acquiring customers.[ProfitWell].

A high average customer lifespan is essential to balance out this investment.

Retail Industry Approach

In contrast, retail businesses might have lower initial production costs but higher inventory upkeep expenses.

This affects their ability to acquire new paying customers at an affordable rate [Shopify].

Tech Startups Scenario

The tech startup sector frequently relies heavily on paid advertising campaigns and aggressive marketing spend to build their initial customer base [Neil Patel].

This leads them towards higher than average customer acquisition costs initially with the expectation that it will reduce over time as brand recognition grows.

Navigating Challenges in Reducing Customer Acquisition Costs

Reducing customer acquisition costs is a crucial goal for any business, but it’s not without its challenges.

Maintaining product quality or service standards while cutting down expenses related to production can be difficult. It necessitates meticulous organizing and shrewd choices.

Balancing Cost Reduction with Quality Assurance

The desire to reduce customer acquisition cost should never compromise the value delivered to customers. Ensuring this balance may require investing in efficient production methods that don’t skimp on quality [Forbes].

Optimizing Marketing Efforts Without Overspending

A significant portion of total costs often goes into marketing efforts aimed at acquiring customers. Striking a balance between effective advertising and overspending can pose a challenge, especially when ad spend does not translate directly into paying customers [HubSpot].

Facing Competition While Keeping CAC Low

In highly competitive markets, businesses might feel compelled to increase their spending on paid advertising just to keep up with competitors – which could lead towards higher average customer acquisition costs [Neil Patel]. The key here lies in focusing more on organic growth strategies such as SEO optimization and content marketing rather than solely relying upon expensive ad campaigns.

Maintaining Employee Salaries Amidst Budget Constraints

In attempts to improve profit margins by reducing overall expenditure, companies must ensure they’re still able provide fair compensation for their employees who play an integral role throughout the sales cycle.

FAQs in Relation to How to Calculate Customer Acquisition Cost

What is the method to calculate customer acquisition cost?

The formula for calculating CAC is: Cost of Sales and Marketing divided by the Number of New Customers Acquired during a specific period.

How to calculate customer acquisition cost from financial statements?

Add up all sales and marketing expenses from your income statement. Then, divide this sum by the number of new customers acquired in that same period.

How do you calculate customer acquisition cost for startup?

A startup calculates its CAC similarly – total spend on sales and marketing efforts divided by new customers gained over a set timeframe.

What is customer acquisition cost with example?

If a company spends $5000 on marketing in a year and acquires 1000 new customers, their Customer Acquisition Cost (CAC) would be $5 per customer ($5000/1000).

Conclusion

Calculating customer acquisition cost isn’t a mountain too high to climb.

You’ve got the formula in your toolkit now.

Remember, it’s all about balancing costs and value… making every dollar count.

Your business strategy just got sharper with this key metric on board.

The LTV-to-CAC ratio? It’s no longer a mystery but an ally for your profitability assessment.

Cutting down those CAC figures is not just possible, but also achievable with strategic ad spend optimization and creative quality improvement.

Different industries have their own benchmarks; understanding yours can be enlightening!

Awareness of potential challenges helps you navigate the tricky waters of reducing CAC without compromising service standards or product quality.

Need Help Automating Your Sales Prospecting Process?

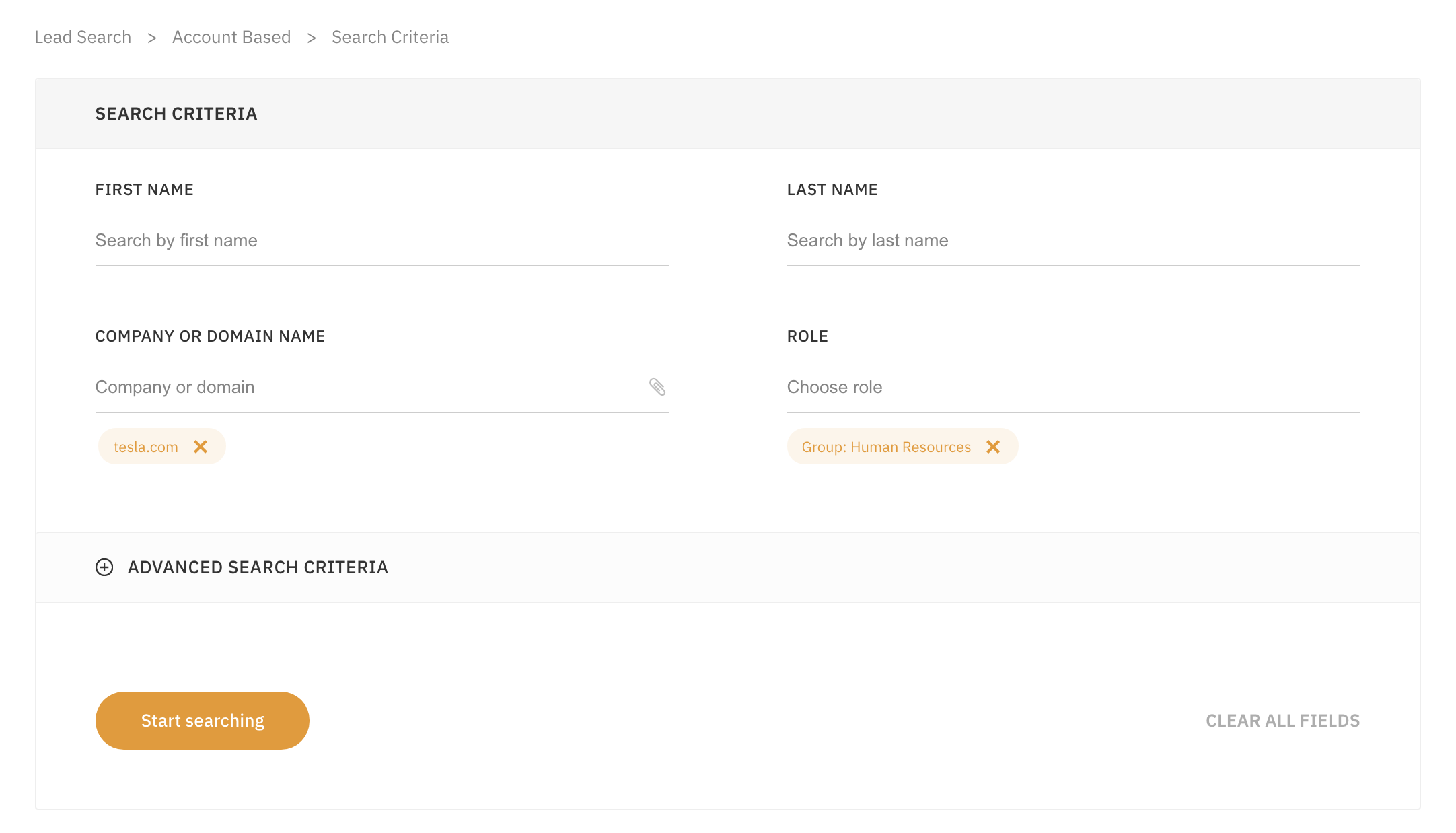

LeadFuze gives you all the data you need to find ideal leads, including full contact information.

Go through a variety of filters to zero in on the leads you want to reach. This is crazy specific, but you could find all the people that match the following:

- A company in the Financial Services or Banking industry

- Who have more than 10 employees

- That spend money on Adwords

- Who use Hubspot

- Who currently have job openings for marketing help

- With the role of HR Manager

- That has only been in this role for less than 1 year

Or Find Specific Accounts or Leads

LeadFuze allows you to find contact information for specific individuals or even find contact information for all employees at a company.

You can even upload an entire list of companies and find everyone within specific departments at those companies. Check out LeadFuze to see how you can automate your lead generation.

Want to help contribute to future articles? Have data-backed and tactical advice to share? I’d love to hear from you!

We have over 60,000 monthly readers that would love to see it! Contact us and let's discuss your ideas!