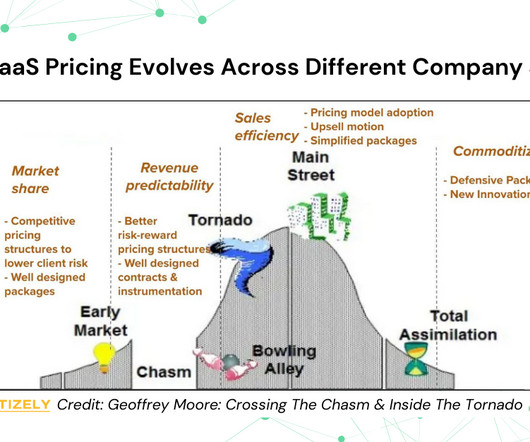

How SaaS Pricing Evolves Across Different Company Stages

Sales Hacker

FEBRUARY 7, 2025

In its early stages, Nosto operated on a performance-based pricing model, charging clients a commission on sales directly attributed to its product recommendations. This stage focuses on maximizing revenue opportunities, optimizing profit margins, and reinforcing a leadership position in the market.

Let's personalize your content