Doubling Down: Karl Alomar, Managing Partner at M13

SaaStr

MAY 23, 2024

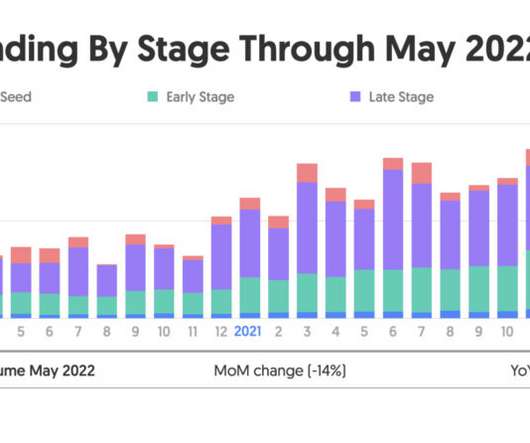

With complimentary offerings from the likes of Chainalysis performing well in this category, my main interest in this business stemmed from excitement in the founder herself and her strong founder market fit. What’s your pulse check on the venture markets right now, today?

Let's personalize your content