The State of SaaS: Stalled Growth is Starting to Rebound with Altimeter Capital Partner Jamin Ball

SaaStr

DECEMBER 21, 2023

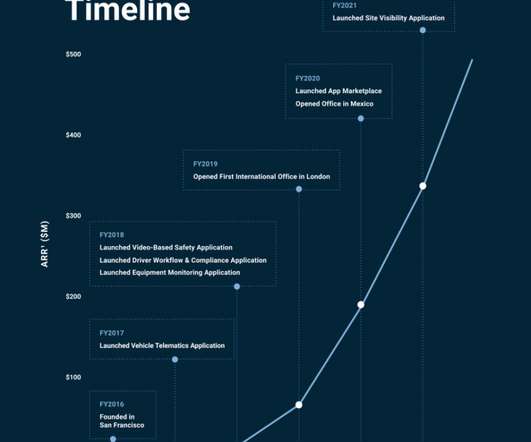

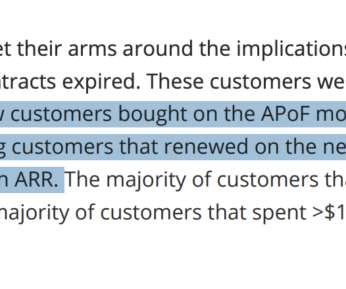

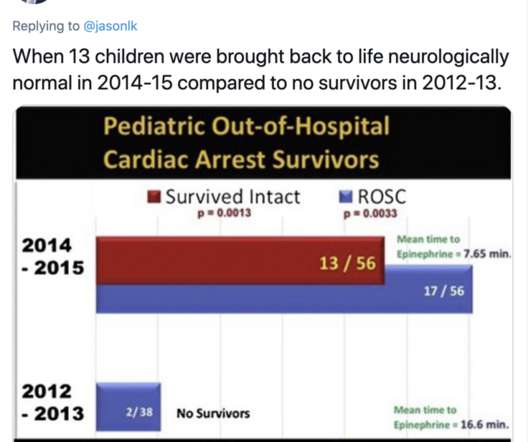

Median Revenue Multiples and Growth Rate is Down This chart is similar to the previous one but without the 10-year rate. Now, a light blue line shows the median consensus NTM growth rate for that same 100 software companies. By comparison, the median growth rate for these businesses from 2015-2017 was 27%. Why is that?

Let's personalize your content