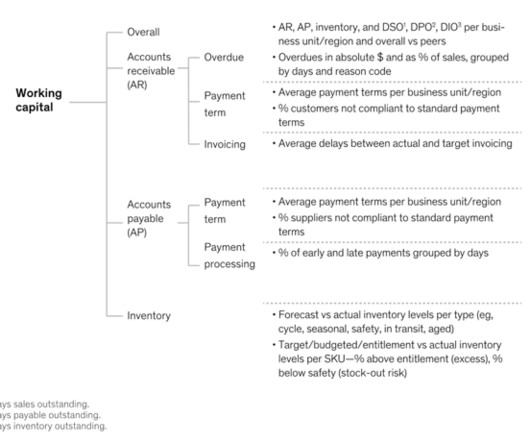

Technology-Driven Solutions for Working Capital Management

G2

MAY 28, 2023

Every day, strategic decisions must be made to monitor, assess, protect, and optimize your business’ cash flow.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

working-capital-management

working-capital-management

G2

MAY 28, 2023

Every day, strategic decisions must be made to monitor, assess, protect, and optimize your business’ cash flow.

SaaStr

SEPTEMBER 9, 2022

During an enlightening session at SaaStr Europa 2022, Zach Coelius (Managing Partner at Coelius Capital) and Tiffany Luck (Investor at GGV Capital) share the secrets and lesser-known players in the world of venture capital. However, there are certain side effects to be aware of when working with a scout.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

SaaStr

MAY 27, 2024

The market is flooded with capital, leading to higher valuations and unrealistic expectations. There is more capital available to startups than ever before. There is more capital available to startups than ever before. This is because: There are more venture capital firms. The competition is more intense.

SaaStr

JANUARY 11, 2024

We had a great one last week with Erica Brescia, Managing Director at Redpoint Ventures. This week we’re focusing on Mark Roberge, Co-Founder and Managing Director at Stage 2 Capital! #1. Stage 2 Capital invests $4M to $6M in first checks into B2B software companies that are around $1M ARR. Check that out here.

Veloxy

DECEMBER 28, 2023

Organizations can create a successful team by aligning goals, fostering collaboration between inside/outside teams and providing resources & training for reps to manage travel schedules while maximizing their potential.

SaaStr

JANUARY 25, 2024

We had a great one last time with Mark Roberge, Co-Founder and Managing Director at Stage 2 Capital. Our current fund is an evergreen, personal capital vehicle that doesn’t have a specific fund size. #3. It takes a special company to be viewed as a breakout worthy of capital. #5. Check that out here.

SaaStr

OCTOBER 8, 2023

Check out this week’s top blog posts, podcasts, and videos: Top Blog Posts This Week: How Is AI Impacting The SaaS Landscape with a16z GP Kristina Shen What To Do if Your TAM is Too Small for VCs Making Less, But Working Less. How to Pitch Your Seed Stage Startup with Y Combinator’s Managing Director Michael Siebel 2.

Sales Hacker

MAY 14, 2024

Holly Chen is the Managing Partner of ExponentialX, a Marketing and Growth Advisory Collective for high-growth SaaS startups, advising companies like Miro, Loom, ServiceNow, Appsflyer in their growth journeys. Holly also worked at Gucci, Deloitte Consulting. 46:33 – One thing that is working for Holly in go-to-market right now.

SaaStr

DECEMBER 2, 2023

The sales-driven SaaS companies that are very capital efficient generally end up at 4x-5x or greater as a ration of average quota attainment / average OTE. If you can raise a ton of capital, it’s one strategy to win and crush the competition. Where you burn a ton of cash is “buying” sales. Starving” reps with too few opportunities.

SaaStr

NOVEMBER 25, 2023

The most important thing you can do at a tactical level is almost always the same: use the capital at this stage to double down on what is working. You’ll be tempted to use the capital to enter new markets, to expand into new segments, to try out new verticals. Upgrade the management team. Have a customer conference.

SaaStr

SEPTEMBER 25, 2022

SaaStr 591: The Key to Successful Scaling Across Markets, From a Founder Turned VC with OMERS Ventures Managing Partner Harry Briggs. Live from SaaStr Annual 2022: Optimizing GTM for PLG with Stage 2 Capital MD Mark Roberge. Top Videos This Week: 1. Everything that Breaks on the Way to $1B ARR with Mailchimp Co-Founder Ben Chestnut.

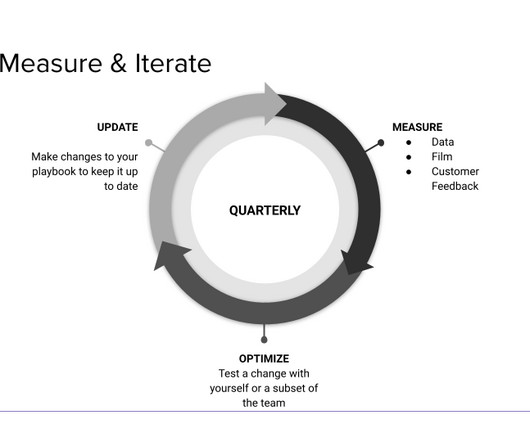

SaaStr

DECEMBER 12, 2023

Mandy Cole, Partner at Stage 2 Capital, shared the five steps every company needs to take to build their first GTM playbook centered around the buyer. If we’re designing a process that will work well, it needs to start with the buyer. Stage 2 Capital uses a Green/Yellow/red scenario. Green is a “go after them.”

SaaStr

MARCH 19, 2024

His day-to-day role as a first-time founder involves a lot of work around creating and building the MVP product and filtering out all of the noise in this SaaS ecosystem. You want to be scrappy and figure out how to do as much as possible without deploying the capital you’ve raised and preserving that money to build a product.

SaaStr

MAY 4, 2024

SaaStr Fund manages almost $200,000,000 to invest in Seed and Late Seed B2B startups, from $10k-$200k in MRR. But the insiders wanted to invest more, so they took in a modest amount of extra capital ($12m) at a slightly higher price. There are so many benefits in 2024 of growing in a capital-efficient fashion. Much more here.

SaaStr

APRIL 9, 2023

Check out this week’s top blog posts, podcasts, and videos: Top Blog Posts This Week: My Top 10 Mistakes In 10 Years: Gainsight CEO Nick Mehta 8 Things That Are Just Harder in SaaS Now The Pros and Cons of Working Directly for the CEO Cutting Off Your Long Tail: When Is It Worth It? appeared first on SaaStr.

SaaStr

DECEMBER 7, 2023

Kicking us off is Jay Levy, Managing Partner at Zelkova Ventures. #1. In today’s market investors are keen on companies that can be incredibly capital efficient and have significant runway to get to break even. #4. We typically invest in 6-8 deals a year and reserve significant follow-on capital for these companies.

Partners in Excellence

MARCH 2, 2024

He’s one of the most fascinating sales leaders I’ve worked with. Since Tekelec, he has been involved in a number of technology start-ups, has developed a specialized fund, providing seed capital to some start-ups. I first met him years ago when he ran global sales for Tekelec (acquired by Oracle).

Martech

DECEMBER 18, 2023

Leading customer relationship management (CRM) and other marketing platforms are integrating sophisticated AI capabilities that promise to assist with key functions like gauging customer sentiment, training employees, making product recommendations, enriching data and even auto-generating targeted campaigns.

Search Engine Land

DECEMBER 1, 2023

Capitalize on seasonal topics Using tools like Google Trends and Semrush, look for trending keywords related to the holidays. Things like gift guides are always popular, but if you are working on a website that isn’t product-based, there are still plenty of opportunities. Just be mindful that these links are not often permanent.

SaaStr

FEBRUARY 16, 2023

Our breadth and depth of expertise and A-SCEND, our proprietary compliance management platform, enable you to assess against the leading cybersecurity compliance frameworks important to your business – with one partner. Deel works for independent contractors and full-time employees in more than 150 countries, compliantly.

SaaStr

DECEMBER 14, 2023

We had a great one last week with Jay Levy, Managing Partner at Zelkova Ventures. Mary was previously named to the Forbes 30 Under 30 List in Venture Capital and is a protagonist in a Harvard Business School case on Bessemer’s Century Fund. Check that out here. What’s your most recent disclosed investment?

Veloxy

JUNE 15, 2023

Essential skills for success include strong customer relations, business development, account management & problem solving abilities. The role of an outside sales rep involves working without a fixed schedule and focusing on building and maintaining relationships with current and prospective customers. You can learn more here.

Martech

DECEMBER 21, 2023

I especially like the random capitalizations. It works with any email service provider and lets businesses generate video avatars that speak customized content to each recipient. The integration helps data managers to save time and effort and to easily incorporate AI-generated insights into TapClicks dashboards and reports.

SaaStr

APRIL 14, 2023

At SaaStr’s APAC 2023, Vertex Ventures General Partner Carmen Yuen, GGV Capital Managing Partner Jenny Lee, Square Peg Capital Partner Piruze Sabuncu, and moderator Arnaud Bonzom (Co-Founder and Managing Director of Black Mangroves) discuss the common pitfalls to look out for when you are raising your Series A.

SaaStr

JANUARY 9, 2024

Perhaps the biggest change though is how many folks want to manage a team, versus do the work themselves. The 1000+ unicorns of Covid fueled this, with ample capital to hire, hire and hire. Not just hire and manage people?”. He took a pause and said, “I just don’t want to work that hard.” He finally got it.

SaaStr

JANUARY 29, 2021

Go work at a fund first and make some good investments there. Assuming you have at least a partial track record, then, there are two-and-a-half basic paths on how to start a venture capital firm. Start Small before your start a Venture Capital Firm. Grow within a Venture Capital Firm. How Does a Venture Capital Firm Work?

Heinz Marketing

SEPTEMBER 14, 2023

By Tom Swanson, Engagement Manager at Heinz Marketing Change is a constant companion today. If you fail to capitalize, someone else will. So how do you drive change in a way that works? There are many models, classes, and blog posts about managing change. If you have gotten to this part of the post, I assume it worked.

SaaStr

SEPTEMBER 18, 2022

SaaStr 591: The Key to Successful Scaling Across Markets, From a Founder Turned VC with OMERS Ventures Managing Partner Harry Briggs. ?. Live from SaaStr Annual 2022: Optimizing GTM for PLG with Stage 2 Capital Managing Director Mark Roberge. How to Build a Super High-Retention Sales Team with Twilio SVP & GM Alice Katwan.

SaaStr

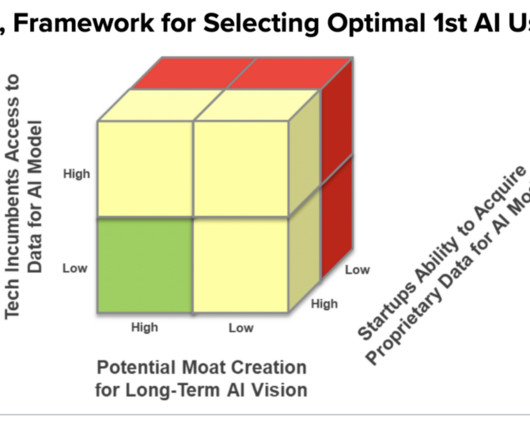

NOVEMBER 17, 2023

At this year’s SaaStr Annual, Mark Roberge, co-founder and Managing Director of Stage 2 Capital, takes the stage to have a bake-off between startups and incumbents when it comes to who will win the AI Go-to-Market race. The Innovator’s Dilemma is the long-time work of Clayton Christensen, a Professor at Harvard Business School.

SaaStr

NOVEMBER 9, 2023

Who’s on the hook for raising capital, managing the board, firing and hiring the executives, etc. If being co-CEOs is what it takes to make that partnership work, maybe so be it. Like many things, I’ve mellowed a bit on this over time. I traditionally thought co-CEOs were a terrible idea. That can be so powerful.

SaaStr

OCTOBER 16, 2022

The Confusing and Confounding Advice on Capital Efficiency. The Early Hire That Almost Never Works: Director of Outbound. SaaStr 597: VC State of the Market with SaaStr CEO Jason Lemkin and Cowboy Ventures Founder & Managing Partner Aileen Lee. ? ? ?. Why The Business Model of Venture Capital is Really, Really Hard.

SaaStr

MAY 23, 2024

We had a great one last time with Andrew Steele, Partner at Activant Capital. This week we’re focusing on Karl Alomar, Managing Partner at M13! #1. Karl Alomar serves as the Managing Partner of M13, an early-stage venture firm investing in visionary founders building disruptive software businesses. Check that out here.

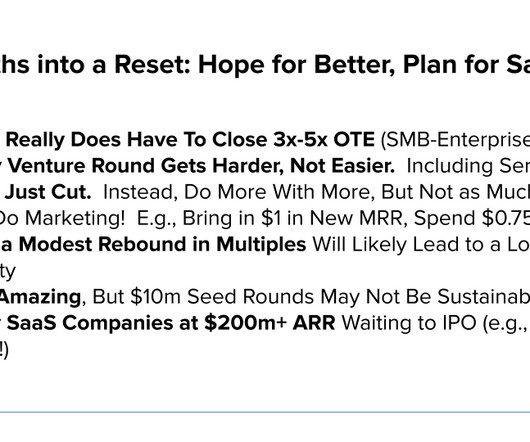

SaaStr

MAY 23, 2022

But public stock prices are way down, and venture capital is much tighter than it was just a few months ago. So many of you will want to manage the burn more carefully. Have a firm, management-team wide burn rate budget. I know this is a broken record on SaaStr, but it works. This is more capital efficient for you, too.

SaaStr

SEPTEMBER 16, 2021

Featuring 3 prominent Founders – from Calendly, Coda and LaunchDarkly – that have achieved scale, at “Founder Confidential” you will hear about the highs and lows of fundraising, working with a VC board, and real talk about what it really is like to be a true Founder. . Active Capital. Advaita Capital .

SaaStr

JANUARY 11, 2023

So, who are these two SaaS leaders, and what experience do they draw from that helps inform their thoughts on capital, the market, and entrepreneurship? . After building a successful portfolio, Lemkin struck out on his own and is the Managing Director of SaaStr Fund and the CEO of SaaStr. The Backstory.

SaaStr

JUNE 17, 2023

In the ever-evolving landscape of SaaS, Venture Capital, Bootstrapping, and Valuations – understanding market trends and investment patterns is critical. For instance, video conferencing software Zoom saw an unprecedented surge in demand as remote work became widespread.

SaaStr

JULY 21, 2022

Jason Lemkin, Founder & CEO @ SaaStr and Aileen Lee, Founder & Managing Partner @ Cowboy Ventures sit down to discuss the current state of venture capital. Optimizing GTM for PLG with Stage 2 Capital. VC State of the Market with SaaStr’s CEO and Cowboy Ventures. Ticket prices go up at the end of the month!

SaaStr

JULY 31, 2023

Until about 2018, the biggest funds tending to gobble up most of the available capital. Established funds are sucking up the vast majority of available capital. As a founder, I never really cared that much what I sold, what product I worked on. VCs have their own investors, the LPs (Limited Partners).

Closing Bigger

MAY 9, 2024

This training helps in understanding and managing one’s own emotions and effectively responding to the emotions of others, which is critical in customer interactions. His clients include Ford, Coast Capital, Wesgroup Equipment, US Bank (Elavon), The Canadian Armed Forces and hundreds of other organizations globally.

SaaStr

AUGUST 30, 2022

This happens with some regularity in SaaS, I’ve learned (and to be clear: I’m not talking about any company I’ve invested in, am an advisor to, board member of, etc – Because when it’s still a very small team, with no true management team … co-founders can kind of hack it to $1m-$2m in ARR together.

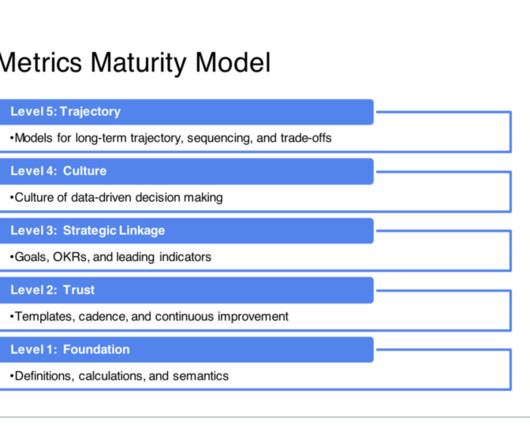

SaaStr

DECEMBER 13, 2023

Dave Kellogg, EIR at Balderton Capital and 25-year C-level veteran, shares the top 14 signs that you have a SaaS metrics problem, the five reasons those symptoms exist, and a SaaS metrics maturity model with five layers to help you move the needle at every stage. Numbers are used to bludgeon management. 3: Deja vu. 7: Inexplicability.

Partners in Excellence

AUGUST 25, 2023

If we fail to serve the customer well in those projects, they will find someone else, or we never get contracts for the additional work. I may pay monthly service charges for keeping an account or managing a portfolio. What about capital equipment? There are endless recurring revenue opportunities with capital equipment.

SaaStr

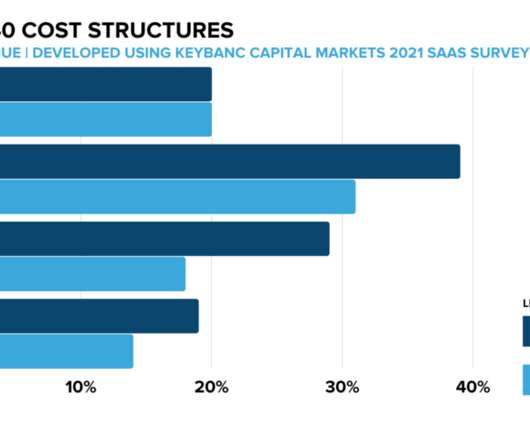

NOVEMBER 4, 2021

” Fortunately, the always excellent KeyBanc Capital Markets (KBCM) 2021 SaaS Survey – which covers over 350 private SaaS companies across various stages and categories – provides a very rich data set to work from. Capital efficiency is especially important when capital is scarce.

SaaStr

DECEMBER 21, 2023

Canvas Ventures manages $835 million in AUM, currently investing out of our third, $350 million fund. Historically, the headlines read “venture capital is dead ” every 7 to 10 years. Founders have to make tough, thoughtful decisions about where to deploy capital. #5. And how big is your current fund? Venture is cyclical.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content